In the ever-changing dry bulk trades, staying ahead of the curve requires not only an understanding of geopolitical risks but also the use of advanced data platforms.

Recently, we partnered with BIMCO Chief Shipping Analyst, Niels Rasmussen, to deliver an insightful webinar titled ‘Understanding Geopolitical Impacts on Dry Bulk Market Dynamics.’ Dry bulk market professionals may watch Niels’ full expert analysis on-demand here.

In this article, we look back at some of the key points raised in Niels’ presentation and unpack a range of ways in which data and analytics can help ship owners mitigate external risk factors competitively. We then explore how innovative data solutions are revolutionizing the way shipping companies navigate the complexities of the industry.

Today’s Geopolitical Risk Landscape

Geopolitics can make and break markets. Understanding the prevailing impact and influence it has on global maritime trade and industry is critical to business resilience in shipping. From a bulk market perspective, Niels Rasmussen recounts several shifts in dry market dynamics that are either primarily geopolitical in nature or have the potential for significant geopolitical implications. Here are some key examples:

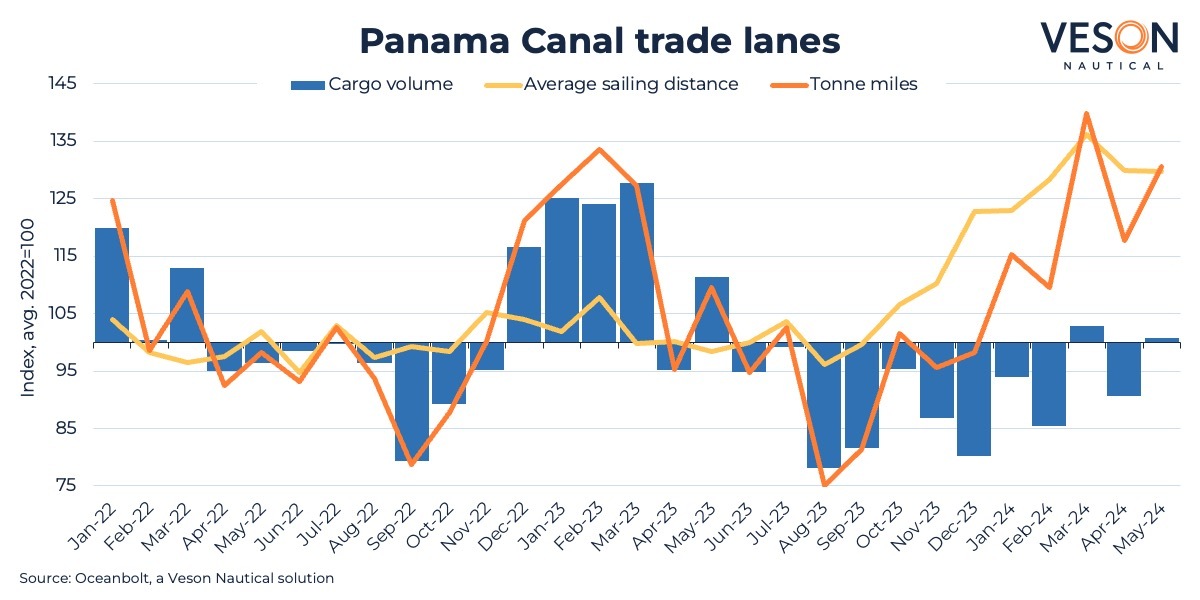

Panama Canal water levels

Through March 2024, Panama Canal water levels were at a historic low, leading to restrictions on the number of vessels allowed to pass through. This resulted in an 80% year-over-year decline in bulk transits through the canal and a significant increase in average sailing distance and tonne-miles for routes that typically use the canal. While low water levels amount to an environmental risk, the impact on trade routes, especially those between the US East Coast and East Asia, had significant geopolitical implications due to shifts in global trade patterns and economic relations.

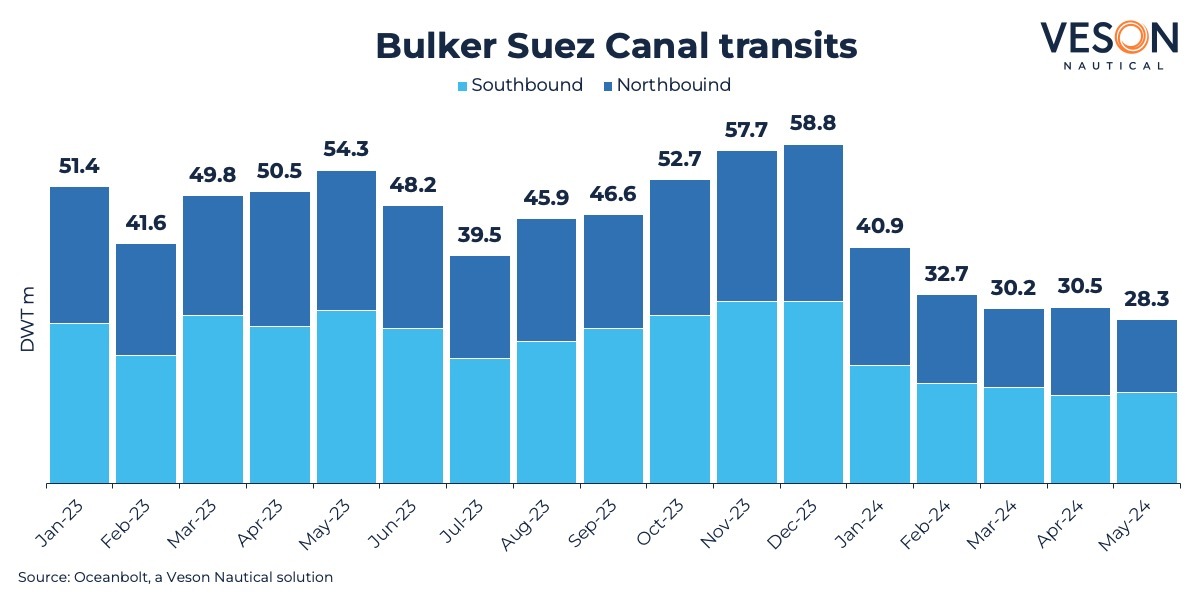

Attacks in the Red Sea

From November 2023 to June 2024, 62 vessels were attacked by Houthis in the Red Sea. Naturally, this has had significant geopolitical implications for maritime security and global trade, particularly for vessels passing through the Suez Canal. As the monthly rate of attacks spiked at 14 in December 2023, a corresponding drop in bulker transits followed, with many vessels rerouting to the Cape of Good Hope, affecting global shipping routes and trade efficiency.

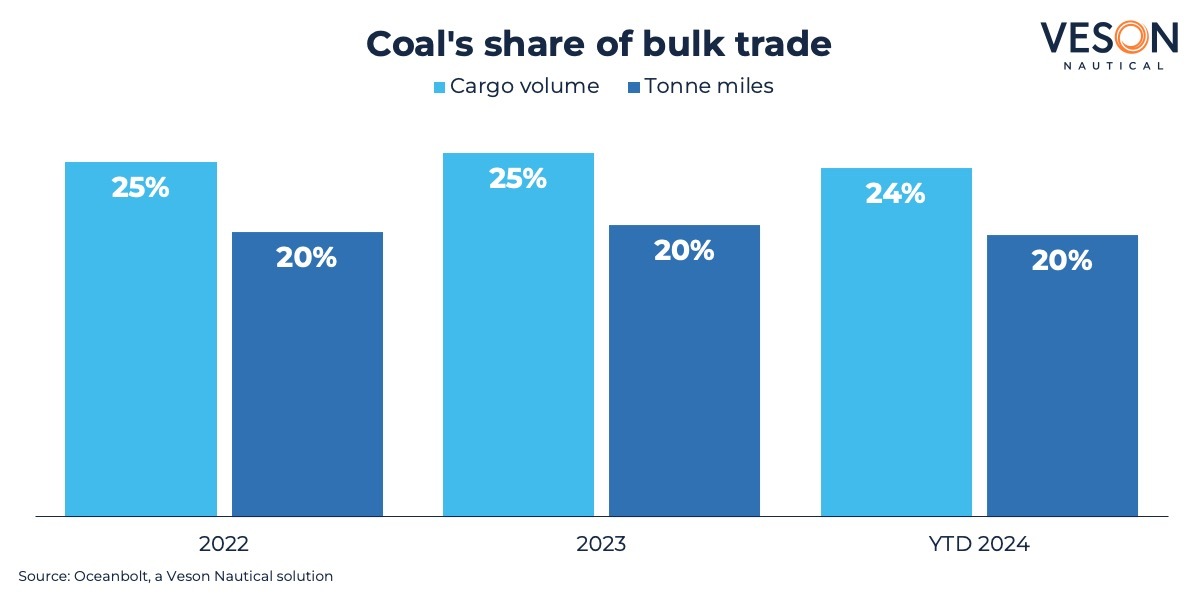

Decarbonization and coal demand

As a result of the worldwide focus on decarbonization and environmental sustainability, the International Energy Agency (IEA) predicts that coal demand has already peaked. For dry bulk commodity producers and vessel operators, this has substantial geopolitical implications as coal is the second-largest bulk commodity at 24% of total cargo volume. The shift away from coal affects global energy markets and trade flows, with the potential to alter geopolitical alliances and energy dependencies.

Meanwhile, the expansion of renewable energy is expected to intensify demand for iron ore, as steel is used in the construction of both solar panels and wind turbines. This transition may offset the decrease in coal demand, reshaping global trade dynamics and fostering new geopolitical relationships focused on renewable energy resources. For more insight and information on these dynamics, read our whitepaper on Bauxite trade flows: The Emerging West-African Dry Bulk Supplier.

Understanding the broader market through detailed analytics

Advanced data platforms, such as IMOS and BIMCO SHIP PI, provide unparalleled visibility into ship performance, global commodities and trade flows. Those who are taking advantage of these platforms have real-time data at hand which empowers them to make informed decisions at-pace. But these platforms are more than just data providers. They offer opportunities to transform how maritime businesses respond to risk. By integrating real-time data analytics with predictive modeling, these platforms enable businesses to predict market shifts, optimize routes, and enhance overall operational efficiency. This level of insight is crucial for navigating today’s unpredictable waters of global trade.

Shortly after the Veson-BIMCO webinar, Veson’s Chief Commercial Officer, Russ Hubbard, discussed the importance of putting data in context. Russ pointed out that it was the ability to respond swiftly to sudden geopolitical events that creates resilience. For instance, during the MV Ever Given incident in the Suez Canal, real-time data could have offered alternative route options, minimizing delays and economic impacts. Similarly, advanced data platforms help companies avoid high-risk areas, enhancing vessel safety and the prompt delivery of goods.

Moreover, understanding the broader market context through detailed analytics allows maritime businesses to foresee potential disruptions. This approach is not just about risk management; it is about using insights to find new opportunities. For example, shifts in trade policies can open alternative markets for commodities, which ship owners can capitalize on with the right data insights.

Strategic benefits of advanced data solutions

- Market Intelligence: Detailed market intelligence helps companies understand commodity supply and demand trends. This intelligence is crucial for making strategic decisions about cargo bookings, route planning, and fleet deployment.

- Risk Management: Predictive analytics allow companies to assess potential risks from geopolitical events and environmental factors. This foresight enables the development of contingency plans that minimize disruptions and financial losses.

- Operational Efficiency: Real-time data on port congestion, weather conditions, and vessel performance enable companies to refine their operations. Efficient route planning and prompt adjustments reduce fuel consumption and operational costs.

- Sustainability: Insights into emission levels help companies adhere to environmental regulations. Understanding the environmental impact of shipping operations is essential for meeting global sustainability goals.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) with maritime data platforms is poised to revolutionize the industry. These technologies enhance the predictive capabilities of data analytics, allowing companies to foresee and react to potential disruptions with greater accuracy. For example, AI can analyze patterns in data that humans might miss, providing insights that lead to more efficient and effective decision-making.

AI and ML can also contribute to more precise risk assessments. By continuously learning from new data, these systems improve over time, offering increasingly exact predictions about market trends, geopolitical developments, and environmental impacts. This iterative learning process is vital for keeping a competitive edge in the fast-paced maritime industry.

Conclusion

The future of maritime shipping lies in the strategic use of data and technology. Advanced data platforms are at the forefront of this transformation, offering the insights and tools needed to navigate the complexities of global trade. By using real-time data, predictive analytics, and market intelligence, maritime organizations can enhance their operational efficiency, mitigate risks, and achieve sustainability goals.

For maritime professionals looking to deepen their understanding of geopolitical impacts and how data can drive strategic decision-making, you can access the on-demand webinar “Understanding Geopolitical Impacts on Dry Bulk Market Dynamics:”

Mikkel Nordberg

Mikkel Nordberg

Philippe Pagnotta

Philippe Pagnotta