EU ETS compliance solutions to keep you on track.

- Introduction

- Our clients

- Commercial impact of maritime sustainability

- By the numbers

- How IMOS helps

- Related solutions

- Frequently asked questions

- Relevant resources

- Featured experts

- Contact us

Managing EU ETS compliance for maritime is easier than you might think. Learn how Veson solutions can help.

The EU’s emissions trading system is a decarbonization regulation expected to cost the maritime industry more than $3 billion in 2024 alone. The EU ETS for maritime operates as a cap-and-trade system, wherein European Union Allowances (EUAs) are auctioned and traded. Emissions incurred from the beginning of 2024 onwards will require the surrender of EUAs, calculated based on voyages to and from EU ports and factoring in the phase-in percentage. The time is now for organizations to take action.

The emission expense settlement workflow in the Veson IMOS Platform offers comprehensive support for EU ETS compliance, including the Carbon Calculator tool for calculating emissions expenses, integrated voyage management capabilities for accurate reporting, and functionality to assess and hedge against carbon risk in the EUA and EUA Futures market.

Meet some of our clients.

“We initially thought the biggest obstacle would be purchasing and acquiring the EUAs, however this turned out to be fairly simple and straightforward. Together with Veson, we have a strong tool to estimate our accumulating liability over the years, so we can top off our account accordingly.”

— Lars Mathiasen

Head of Commercial Decarbonization & Head of Bunkers, TORM

The key steps in Veson’s comprehensive emission expense settlement workflow

Through close monitoring of regulatory changes and frequent communications with clients and industry players, we have identified four key steps for managing maritime EU ETS expenses. Let’s look at where these fit into maritime workflows and how they can be addressed.

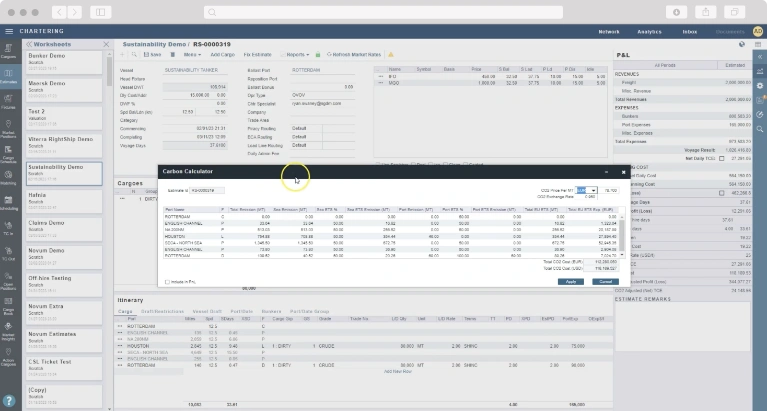

Calculate emissions expenses

It all starts with your pre-fixture processes. The IMOS Platform’s Carbon Calculator allows you to easily calculate the emissions expenses associated with different estimates and run contextual scenario analyses side by side. This allows you to assess the carbon footprint of route deviations and their implications on emissions expenses, for example. Maintain consistent visibility with automatic updates to calculations as variables like bunkers are modified and the incorporation of real-time market data like EUA prices and exchange rates. Further, build EU ETS logic directly into Charter Party contracts with specialized clauses released by BIMCO.

Integrate expense calculations and voyage operations

Next, calculated emissions expenses are translated into noon reports during operations and voyage management. The IMOS Platform seamlessly integrates your emissions expenses into your voyage management operations and supports more precise calculations by accounting for varying definitions of berth versus port consumption and voyage legs spanning multiple years.

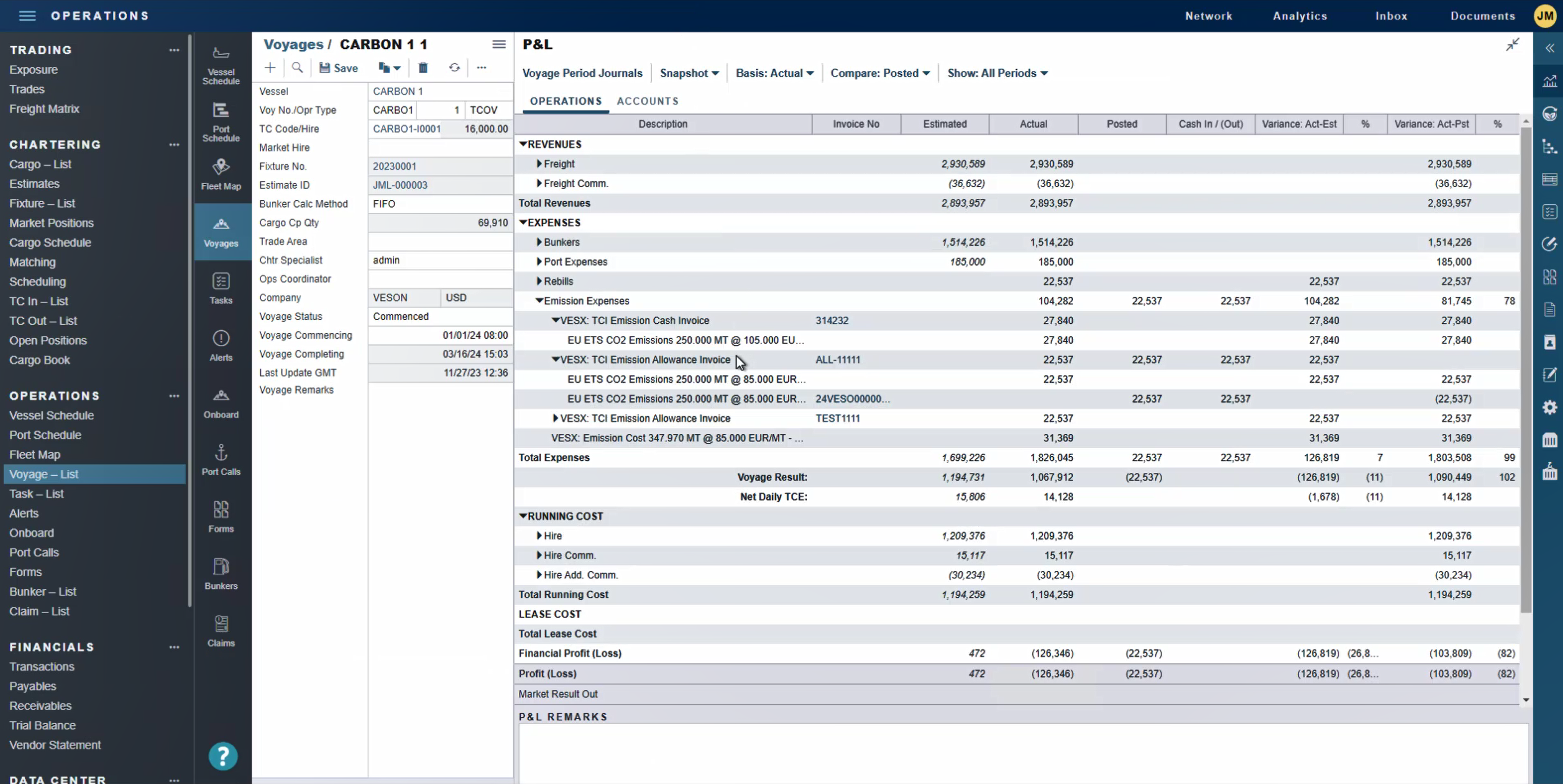

Track emissions and prove compliance

Financials reporting for EU ETS is a crucial step that can easily become convoluted. There is a need to directly track the impact on voyage P&L, understand how to balance different contracts around the transferring of allowances or handling of settlements, and prove compliance with contractual obligations. Leverage the IMOS Platform’s data reporting capabilities to track emissions costs associated with each contract and accurately allocate expenses to different charterers based on cargo, per Sea Cargo Charter guidelines, to avoid financial discrepancies. Then, easily generate detailed reports that demonstrate regulatory compliance.

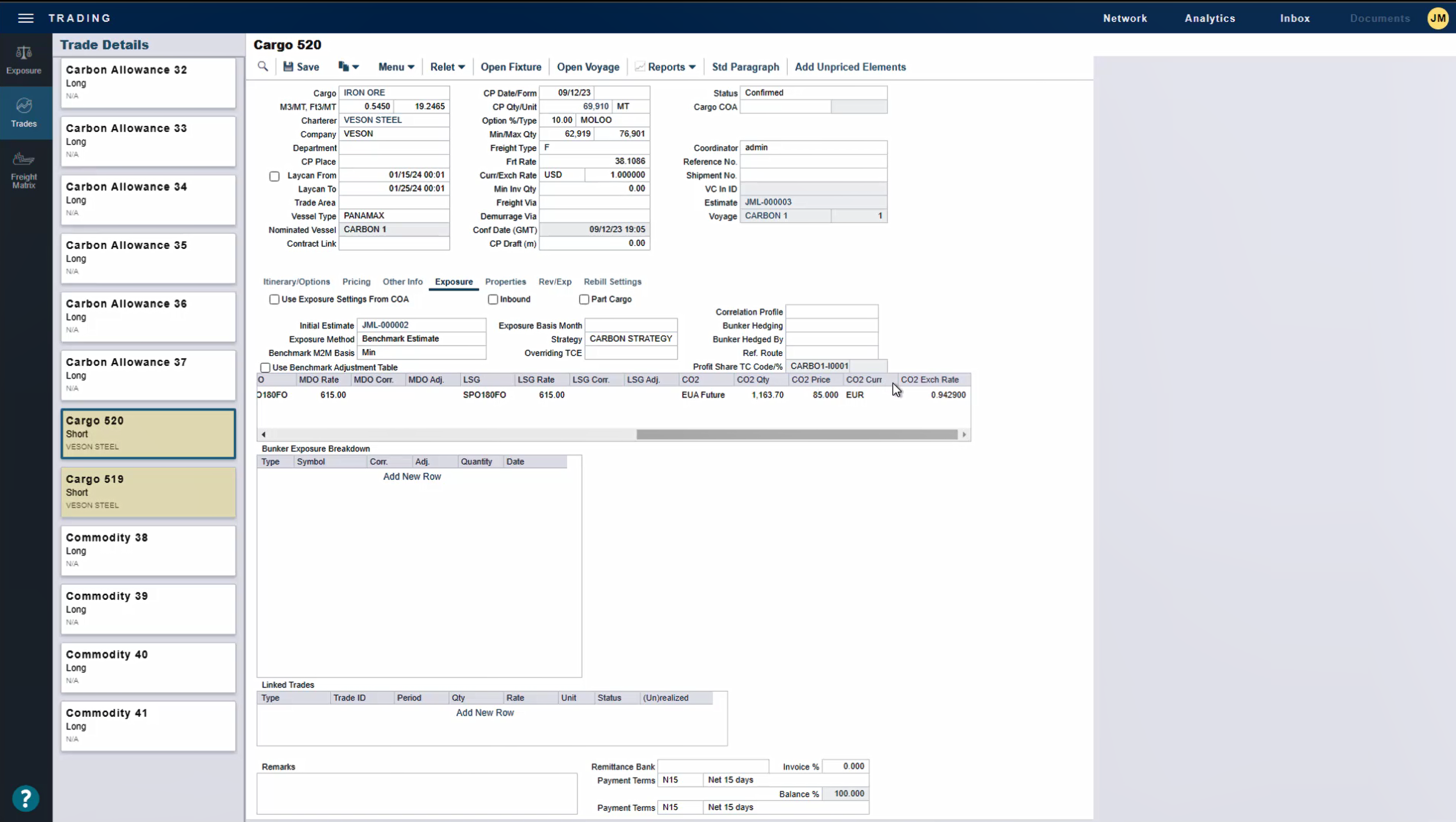

Account for new carbon risk

To comprehensively assess your carbon risk within the EUA and EUA Futures market and devise the right hedging strategies, you’ll need a central workspace to calculate and record associated risk exposure for specific physical contracts as well as monitor paper trades and underlying assets linked to the new market. The IMOS Platform does just that, facilitating the easy calculation of mark-to-market values for physical trades, recording EUA futures in both EUR and USD, tracking them alongside physical contracts, and establishing an inventory of EUAs and EUA Futures contracts to analyze their impact on your net position.

Learn more about addressing EU ETS compliance

Addressing unique EU ETS needs across the maritime industry

How the IMOS Platform supports compliance on all sides of the trade:

Owner Operator

Track voyages and costs over the long term, consider contractual clauses, and manage allowances efficiently to avoid penalties. Allocate yearly credit purchase to specific voyages using accounting methods found in IMOS Trading and Risk.

Commodity Trader

Estimate and track P&L accurately to maximize profits and streamline your workflow. Understand exposure and optimize trades by comparing the verified number of estimated credits against the actual contracts. Allocate credits to specific cargo and integrate third-party credit applications with IMOS Trading & Risk.

Tonnage Charterer

Optimize operations, manage risk, and reduce emissions effectively on every voyage to meet your annual P&L and shareholder targets. Address the needs of your unique supply chains with complex contractual estimations and comprehensive reporting to provide to shareholders.

Seamless workflow for contracts, invoicing, and settlement

Explore key EU ETS functionality within the Veson IMOS Platform.

Precise carbon calculations

The Carbon Calculator allows you to dynamically calculate emissions expenses for each estimate and maintain a clear visualization of the calculation process. It supports both pre-fixture voyage estimation and post-fixture voyage management in the IMOS Platform.

Per-cargo allocation and reporting

The IMOS Platform provides the flexibility to allocate emissions to different charterers on multi-cargo voyages, per Sea Cargo Charter guidelines, using the Cargo Emissions table in Analytics. With robust reporting capabilities, users can easily report on emissions expense data and share it with counterparties.

Carbon risk management

The IMOS Trading & Risk solution for risk exposure management allows you to understand your physical contract exposure. Capture the necessary EUA and EUA Futures to hedge your risk and view your net position in one location.

Discover related solutions

EU ETS Tax

Adapt to carbon pricing and manage emission allowances within your operational workflow.

Voyage Planning

Identify and plan voyage routes that optimize routes and mitigate consumption.

Exposure Management

Integrate and manage environmental risk in your trading strategy in one unified workspace.

Dynamic P&L

Understand seaborne supply chain costs and their impact in real-time.

Efficiency Ratings

Search for vessels by Green specification and track activity in Emission Control Areas.

Regulatory Data

Stay ahead in compliance and operational planning with current and historical regulatory records.

Frequently asked questions

Frequently asked questions about EU ETS compliance.

How does the IMOS Platform’s Carbon Calculator work?

The Carbon Calculator simplifies emissions expense calculations, allows for scenario analysis to understand the emissions impact of alternative shipping routes, and provides real-time financial projections based on market data.

As an example, let’s use the Carbon Calculator to understand the emissions impact for an alternative shipping route that avoids the Red Sea. Assuming a capsize vessel is traveling at an average speed of 14.3kts, we can input a consumption rate of 45 MT/day and a CO2 factor of 3 to conclude that CO2 emissions for this alternate route would increase from 4,500 MT CO2 to 6,250 MT, also increasing those emissions that are applicable to the EU ETS phase-in from 2,370 MT to 3,120 MT. Using an EUA price of €70 and an exchange rate of 0.91, we can also see the equivalent EU ETS Emissions expense would increase significantly from around $182k to around $240k. While these inputs will be subject to the price movements in the market, the indication in this example is that the deviations in routing away from the Red Sea would increase CO2 emissions across all vessel types and would therefore also increase the emissions expense associated with the EU ETS for those routing into an EU country.

Does the IMOS Platform account for new EU ETS contractual clauses, such as those released by BIMCO?

Yes, the IMOS Platform supports the entire lifecycle of a contract, from allowance settlement and expense accounting to contractual agreement changes and allowance transfers. IMOS ensures seamless management of carbon costs by aligning Time Charter contracts with industry standards while offering flexibility for new or custom clauses, such as the EU ETS-specific Time Charter Parties clause and several Voyage Charter Party clauses released by BIMCO.

To learn more about addressing EU ETS contract challenges, tune in to our on-demand webinar featuring representatives from BIMCO and industry leaders TORM and Trafigura.

What EU ETS functionality is available in the IMOS Platform and how do I access it?

Veson delivers an end-to-end workflow to support the changes you are facing with the addition of maritime to the EU ETS. Functionality that is automatically included in the core IMOS system includes the ability to calculate applicable emissions quantity and associated expenses via the Carbon Calculator, capture and update the expense on the voyage P&L, and update contracts to handle cash settlement of the emissions expense. Additional functionality that comes with risk exposure management solution IMOS Trading & Risk includes the ability to capture of EUA contracts and associated derivatives contracts, track exposure to the EUA market using physical and paper contracts, update contracts to handle cash and allowance settlement, and track and report on current inventory of allowances to determine shortages or overages.

While Veson’s emission expense settlement workflow is comprehensive, it is just a starting point. Veson remains committed to refining our functionality to ensure continual support and flexibility in meeting evolving regulatory demands. Ongoing input and feedback from the maritime industry inform the development of the IMOS Platform, ensuring that it remains aligned with industry standards and best practices in EU ETS compliance.

Why invest in a solution for EU ETS management?

By taking a proactive approach to EU ETS and investing in a solution built for the job, maritime professionals can maintain a centralized view of allowances and easily track the business impact on the P&L. Come time to surrender allowances for the preceding year, those who tracked allowances on a per-voyage basis will have a much easier time with compliance and avoid risking the penalties of coming in short. For each tonne of emissions for which no allowance is surrendered in due time, operators must pay a €100 fine as well as pre-pay the remaining allowances for the next year. Names of the penalized operators will be disclosed to the public, and if another mistake is made, the operator may be banned from shipping in the EU.

While it is possible to manage EUA costs manually, it is a tedious effort that is very difficult to audit. As the phase-in logic progresses and the intensity of this regulation ramps up, having a standardized and scalable solution in place will help save significant time and stress as well as protect you from costly fines.

Where can I go to learn more about addressing EU ETS compliance and the IMOS Platform?

Veson University is offering two EU ETS-specific courses that detail the regulation itself as well as how the IMOS Platform handles and supports your EU ETS workflows. This carries through the system from the first calculation of the estimated emissions through to the settlement and realization on the contracts and being able to support and handle all the various clauses. Visit Veson University to learn more about the courses and start standardizing continuous learning across your organization.

Explore relevant resources

EU ETS Toolkit

Useful resources to help your organization along in its compliance journey.

Overcoming EU ETS Contract Challenges Webinar

Learnings and guidance from BIMCO, TORM, and Trafigura.

Preparing for EU ETS Webinar

Your guide to readiness with the Veson IMOS Platform.