In the latest edition of Maritme Market Watch, Veson Nautical’s new weekly subscription report, we explore the sanctioned Tanker fleet and its influence on vessel sales values and earnings.

This market dynamic is particularly significant in light of President Trump’s 23 October sanctions against Russia’s two largest oil companies, Rosneft and Lukoil, which took full effect on 21 November. Whilst intended to pressure Moscow into peace negotiations over Ukraine, these measures may paradoxically accelerate the migration of additional vessels into the dark fleet as Russia seeks alternative means to maintain its oil exports. In turn, Western efforts to constrain Russian revenues may inadvertently reinforce the supply tightness underpinning elevated Tanker rates.

A crucial factor contributing to the current strength in Tanker rates is tight vessel supply due to the expanding dark fleet. While the orderbook shows significant newbuilding deliveries scheduled to enter service, the net impact on available tonnage has been muted. Older vessels are being removed from the conventional trading fleet at an accelerating pace due to sanctions enforcement.

The dark fleet — comprising of older Tankers operating outside traditional insurance, classification frameworks, inadequate insurance, and unmaintained condition — has grown substantially as vessels are recruited to transport sanctioned Russian and Iranian crude oil. These ships effectively exit the transparent market, reducing the pool of tonnage available for mainstream trade. The rate at which vessels are transitioning into sanctions-related service has, in many cases, exceeded the pace of newbuilding deliveries entering the fleet. This creates a supply deficit that continues to support elevated freight rates.

This trend shows little sign of abating. Western governments have intensified enforcement measures targeting vessels involved in sanctions evasion, which has further accelerated the migration of tonnage into the dark fleet. Each vessel that shifts into this trading pattern represents a permanent or semi-permanent reduction in conventional market supply. Even as shipyards deliver new tonnage, the net fleet growth remains constrained because these additions are being offset, and sometimes exceeded, by the ongoing haemorrhaging of existing ships into sanctions-related trades.

This structural supply tightness has proven more durable than many market participants initially anticipated, contributing to the sustained strength in Tanker earnings across multiple segments.

According to VesselsValue’s AIS and ownership data, the dark fleet has grown to substantial proportions; around 713 sanctioned Tankers are now operating outside conventional maritime frameworks. MRs dominate this shadow fleet, accounting for 217 vessels or approximately 30% of the total sanctioned tonnage. Particularly concerning is the prevalence of vessels with undisclosed ownership structures; 132 vessels fall into this category, alongside 109 vessels that have shown no AIS signals for over eight weeks, raising serious questions about maritime safety and environmental liability.

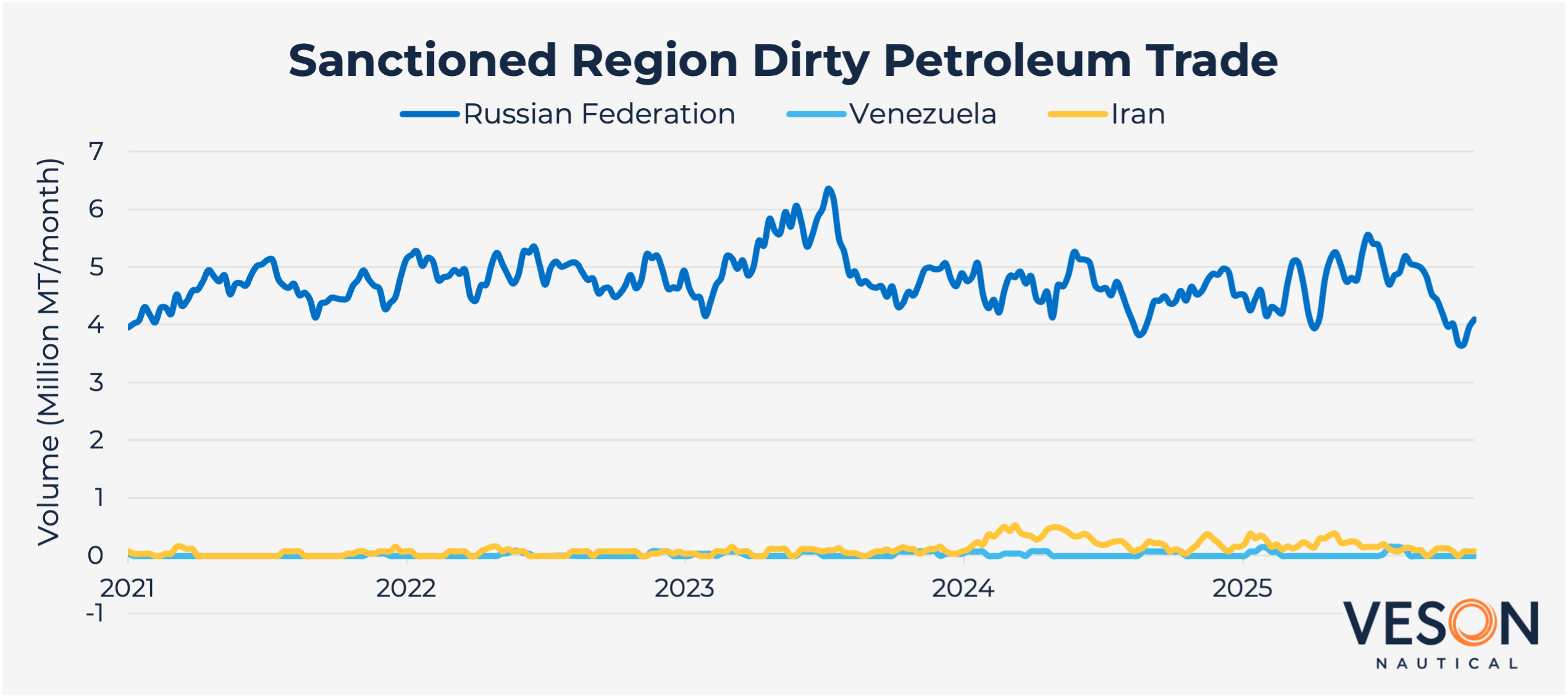

Despite this substantial enforcement effort, with 506 vessels on the US OFAC SDN list alone, Russian petroleum exports have remained remarkably resilient at around 5 mil barrels per day throughout 2021-2025. The relatively modest arrest rate of just seven vessels over the past six months underscores the practical limitations of sanctions enforcement, as the dark fleet continues to facilitate substantial crude flows from sanctioned regimes to major Asian markets.

The tightening supply has driven significant appreciation in both asset values and earnings. Values for older crude Tankers have risen since the start of the year: 20YO VLCCs of 310,000 DWT are up by c.21.45% from USD 33.14 mil to USD 40.25 mil. At the same time, one year TC rates for VLCCs have risen by c.30% over the same period from 41,250 USD/day to 53,666 USD/day.

The expansion of the dark fleet has created an unintended market consequence: Western sanctions designed to constrain Russian oil revenues have tightened Tanker supply, supporting elevated freight rates across multiple segments. With 713 sanctioned vessels now operating outside conventional frameworks and Trump’s Rosneft and Lukoil sanctions set to take full effect on 21 November, this structural dynamic appears poised to persist.

As long as enforcement drives vessels into the shadows faster than newbuildings can replenish the transparent fleet, Tanker owners will continue to benefit from supply-side constraints that prove more durable than many anticipated.

WEBINAR