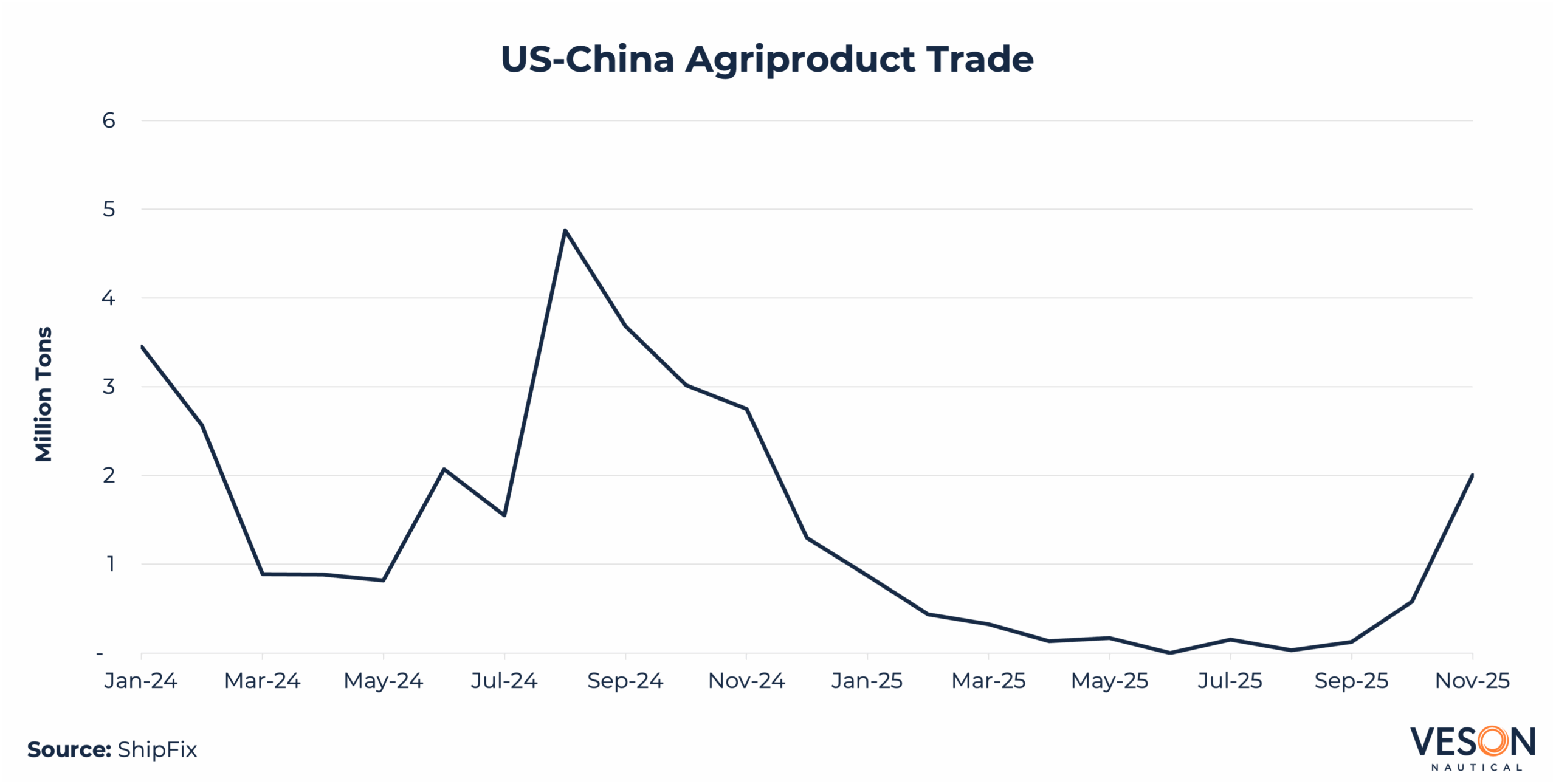

While 2025 has been a strong year for Bulker shipping overall, the Panamax segment has notably lagged behind its peers, underperforming relative to other sub types. According to Veson Nautical data, US-China grain and soybean trade has plummeted by approximately 78% this year, following China’s suspension of US soybean purchases amid escalating trade tensions. This collapse has significantly weighed on Panamax demand throughout the autumn months.

However, a potential turning point emerged following trade negotiations in Busan last October, when Washington announced that Beijing had committed to purchasing 12 mil tons of US soybeans by year-end, with an additional 25 mil tons annually over the next three years. While Beijing has yet to officially confirm these figures, early market indicators suggest meaningful progress.

Forward-looking Shipfix data reveals a notable uptick: more than 2 mil tons of grain cargoes going from the US to China were circulated in November, triple the October volume and more than six times the 2025 monthly average. This resurgence represents a positive signal for the Panamax market, which is poised for heightened activity in the coming month as these grain shipments materialize.

The improving sentiment in the mid-size segment following the recent trade talks has been reflected in the second-hand market. Recent transactions indicate that the value of a 15-year-old Panamax vessel increased by approximately 5% in late November, as appetite for Panamax tonnage strengthened.

The Key Frontier (80,700 DWT, Feb 2011, Universal) sold for USD 18.2 mil at the end of November, a significant premium compared to the similarly aged Kamsarmax Montana I, ( 82,000 DWT, Mar 2011 Daewoo) which changed hands in early October for USD 15.4 mil. This pricing divergence signals improving sentiment in Panamax markets, with owners growing increasingly optimistic about the segment’s prospects.

WEBINAR