The maritime industry is constantly evolving, and keeping pace with industry changes is key to maximizing business outcomes. This requires market insight integrated into the commercial workflow to effectively monitor key trends in the dry bulk shipping markets and predict changes in a meaningful way.

In a recent webinar, I was joined by Niels Rasmussen, Chief Shipping Analyst at BIMCO, to discuss key trends in the dry bulk shipping markets and explore the central role of high integrity market intelligence in navigating change and shaping better decisions. Our conversation included real-life examples from BIMCO as well as a live look at the Oceanbolt platform to demonstrate its ability to visualize market trends, improve predictions, and elevate commercial decisions.

To hear the full conversation, download the Navigating Change in the Dry Bulk Shipping Markets webinar on-demand.

Let’s take a look at some of the highlights from this insightful discussion.

Dry bulk market analysis

Leveraging Oceanbolt data, BIMCO expert Niels Rasmussen guided us through some short, medium, and long-term evaluations of changes to dry bulk cargo flows:

Q: How have cargo flows changed since Russia’s invasion of Ukraine?

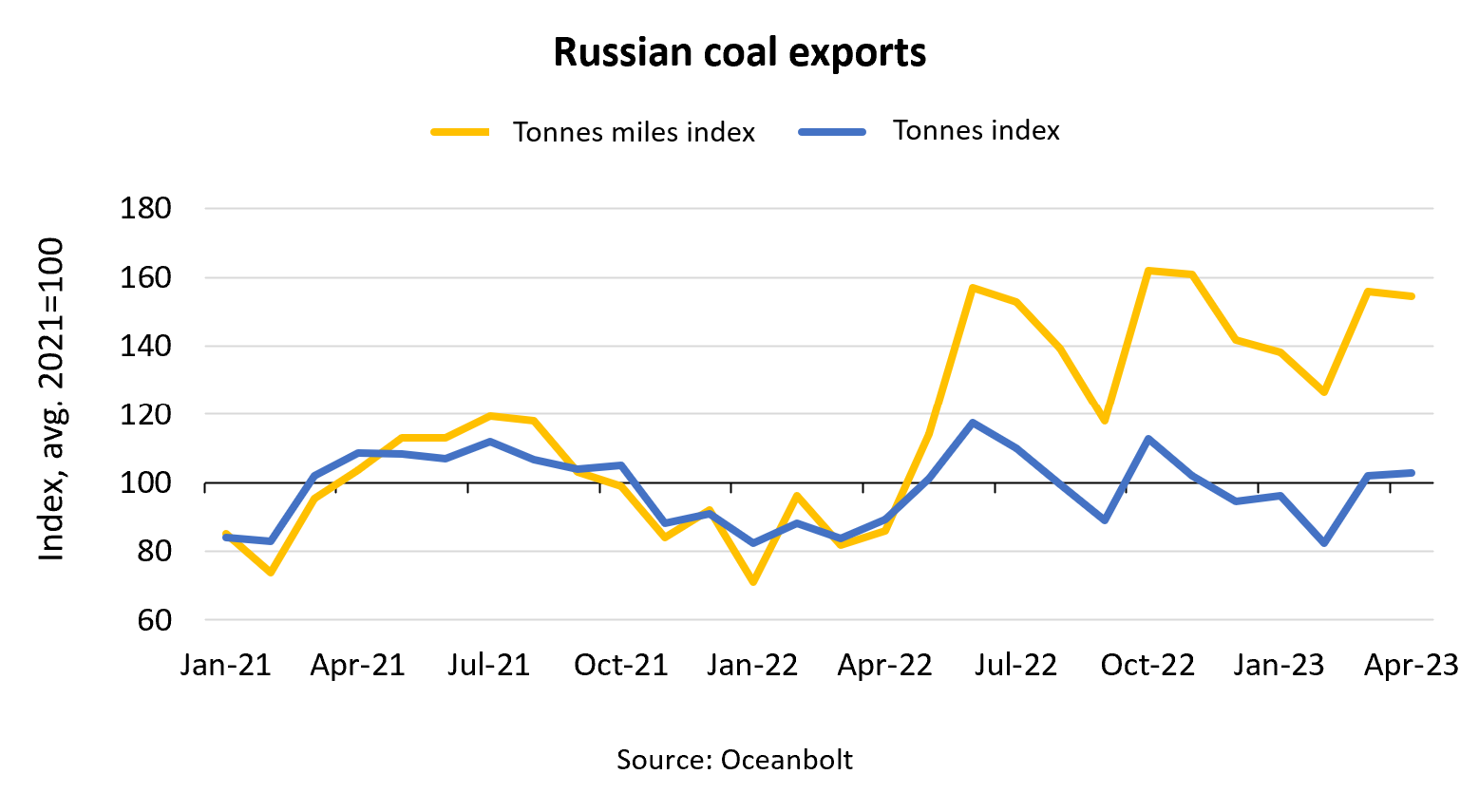

A: Since Russia’s invasion of Ukraine, Russian coal exports have not moved significantly in terms of volume. Tonne miles, however, have increased by 55% since September 2022 when the EU ban of Russian coal took full effect. With EU sanctions and changes in EU buying of Russian coal, Russia is selling to different buyers than they used to. China has been buying significantly more Russian coal, South Korea and India have been buying slightly more, and Japan has opted mostly out of Russian coal.

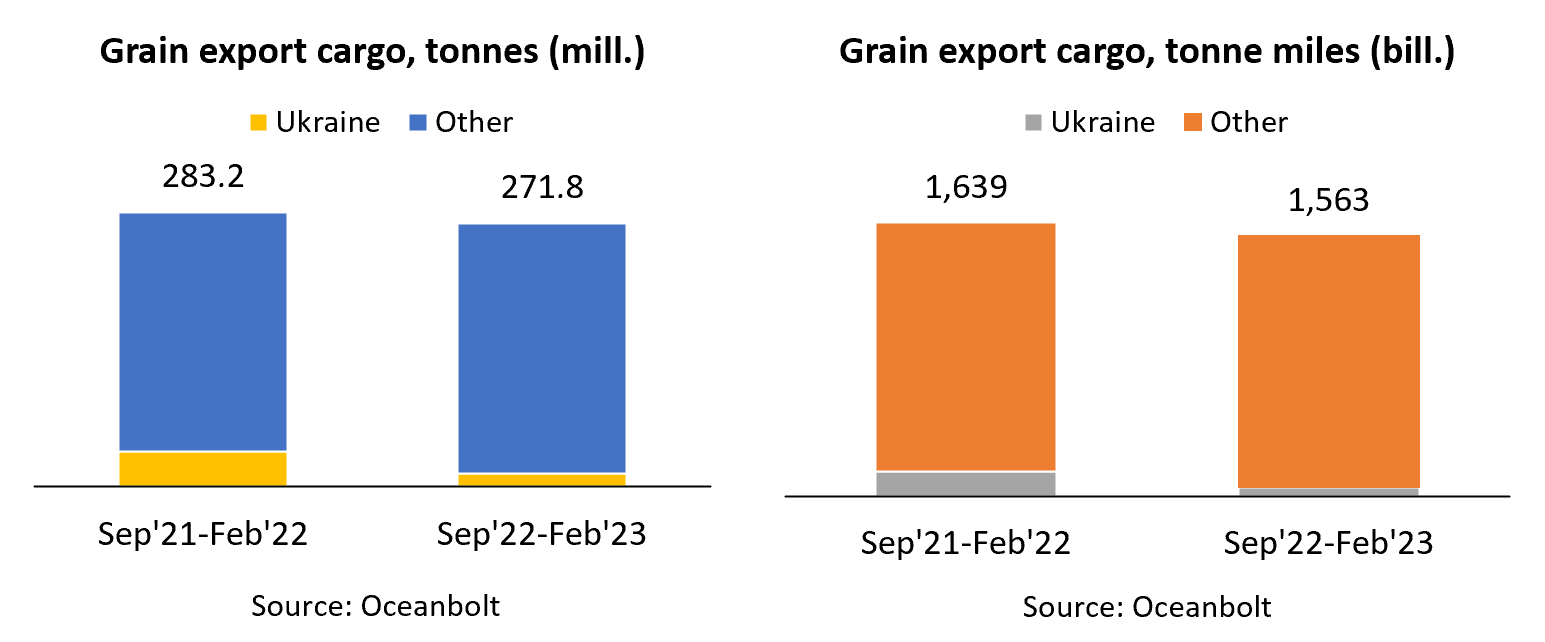

Ukraine has of course suffered quite significantly. Exports are down 60-65% despite the export deal agreed in August 2022. Ukraine used to supply around 13% of all grain cargo but has since only been producing around 4% of the cargo. The rest of world has not been able to make up for the lack of maize (corn) that used to be exported by Ukraine, so corn is still down 19% YoY.

Poll: EU sanctions of Russian coal have benefitted the dry bulk market. We asked webinar participants when they believe the sanctions would end.

- 58% said ‘several years after the war in Ukraine has ended’

- 33% said ‘once the war in Ukraine ends’

- 9% said ‘within the next 12 months’

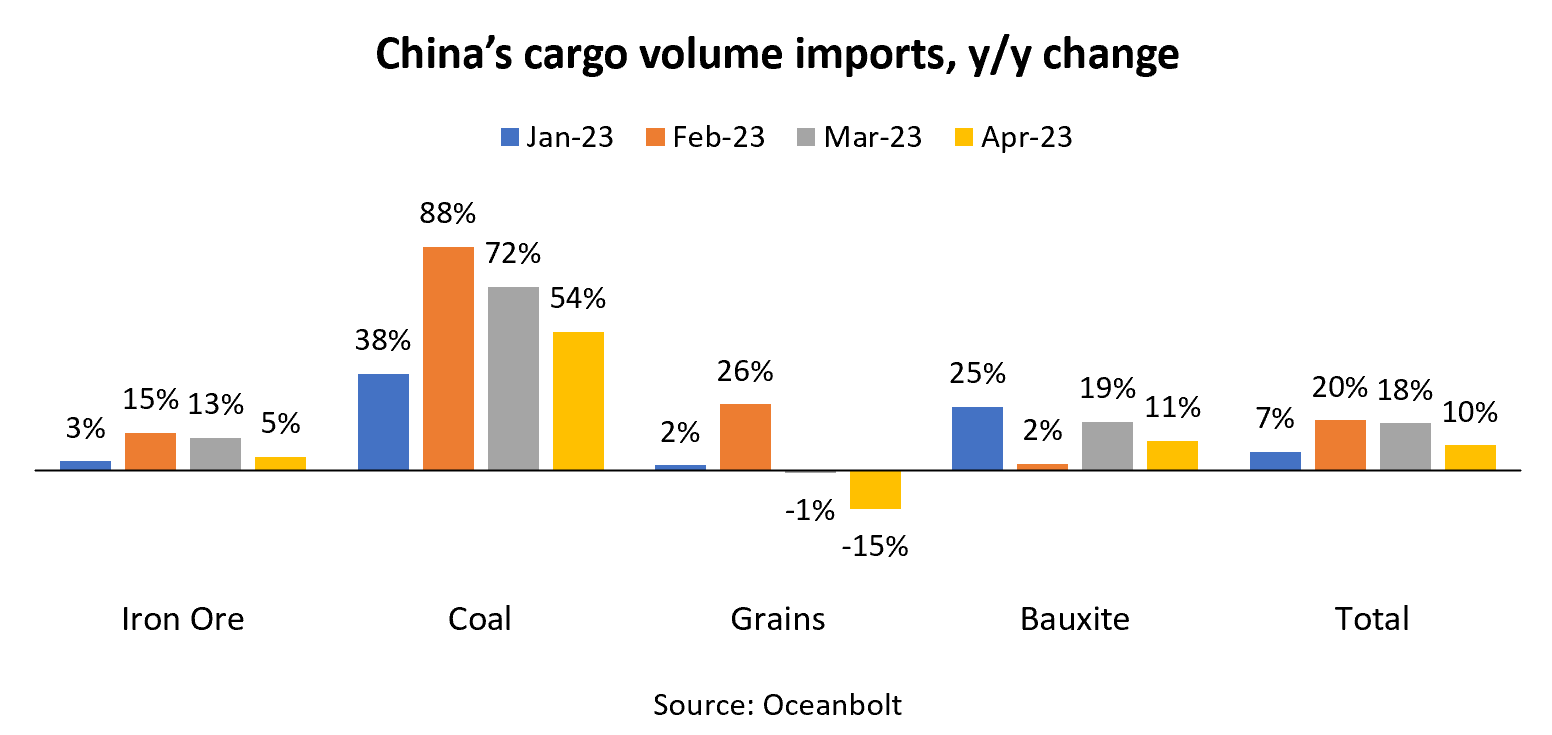

Q: How does the reopening of China impact the market?

A: Year to date, coal imports have been up quite dramatically due to a combination of factors such as government incentives to build up stocks of coal, the reopening of imports from Australia, and the low levels of electricity production from renewable sources so far this year.

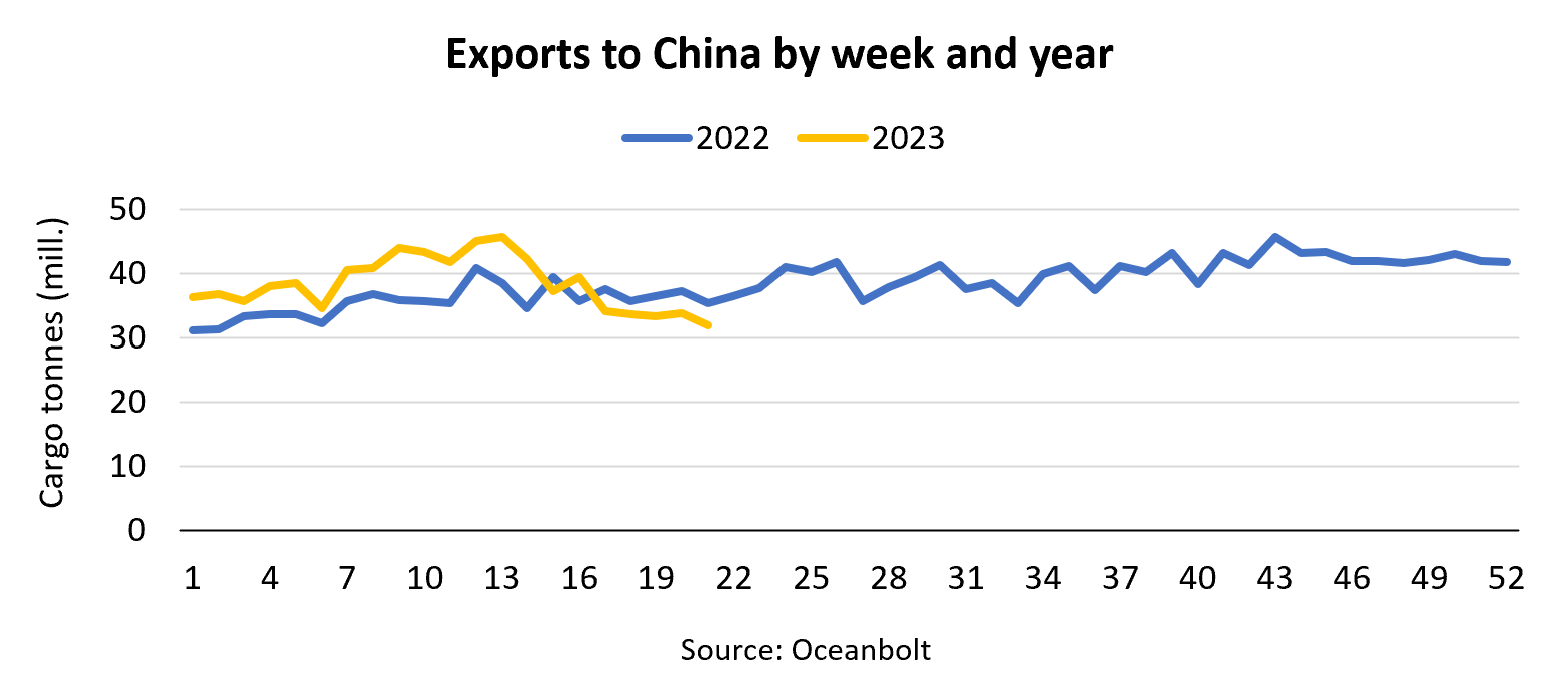

In the last five weeks, however, exports to China have dipped 8% lower than levels from the same time last year. Conditions for China’s manufacturing have been worsening over the past two months, with the PMI for manufacturing dipping below the 50 mark and the PMI for new orders dropping from the mid-fifties to below 50 in May. Another cause for concern continues to be the real estate sector, with sales and new construction continuing a negative trend from 2021 to present.

Poll: Recent data suggests that the recovery in China is proceeding slower than hoped. We asked webinar participants what they believe the recovery outlook will be.

- 65% said ‘Chinese growth wil nor dully recover in 2023’

- 21% said ‘this is a temporary dip and growth will soon recover’

- 14% said ‘Chinese growth will fully recover in the second half of 2023′

Q: Have coal shipments peaked?

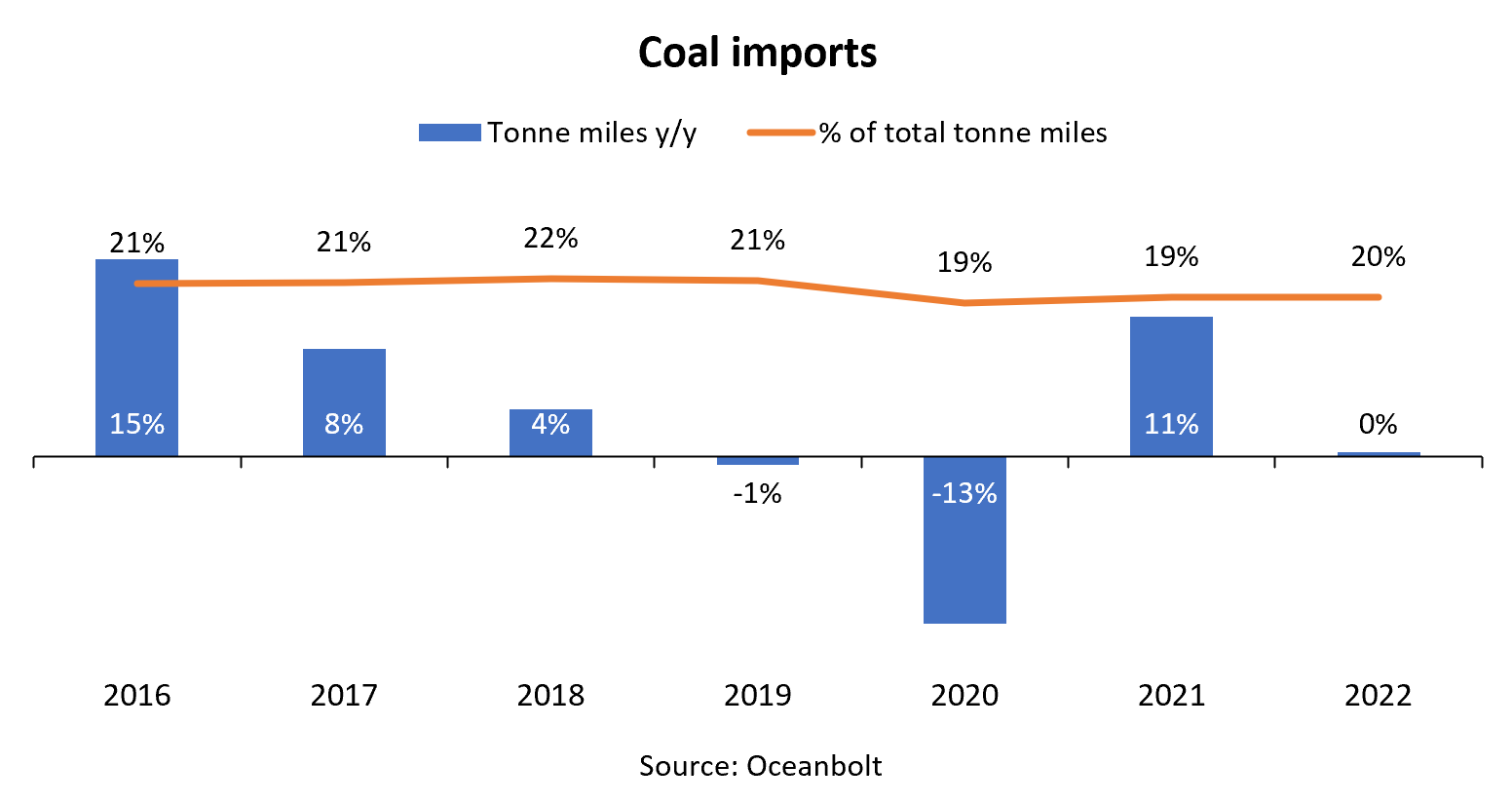

A: Looking at the historic coal shipments, the tonne miles that coal produces peaked in 2018, dipped in 2019, significantly dipped in 2020, and began to recover last year but not enough to bring it back up to 2018 levels. Even though coal is about a quarter of the world’s energy supply, it’s nearly half of the greenhouse gas emissions. This of course makes it one of the fuels that we are very keen to reduce the use of as the world decarbonizes. Additionally, Asia imports 80% of all seaborne coal, however China and India are increasing their own domestic coal production. Reduction in the use of coal combined with more domestic coal production from the major coal importers has led the IEA (International Energy Agency) to predict a 10% fall in coal trade volumes between 2023 and 2025.

Poll: We asked webinar participants when they believe dry bulk coal shipments will peak.

- 44% said ‘they have already peaked’

- 43% said ‘they will peak before 2025’

- 13% said ‘they will peak before 2030’

Q: How could the expansion of marine protected areas agreed under UN’s High Seas Treaty impact shipping?

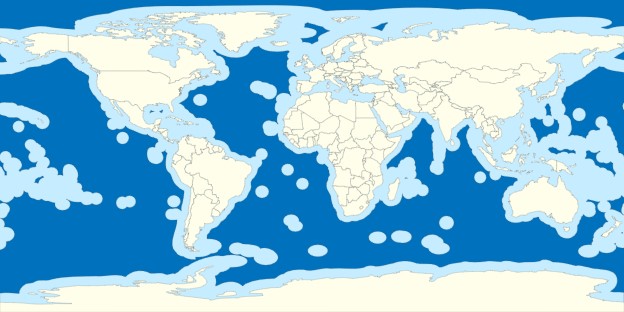

A: So far, Marine Protected Areas (MPAs) have only been enforceable within the exclusive economic zones of each country, leaving no protection in the high seas. The High Seas Treaty, also known as the Biodiversity Beyond National Jurisdiction Treaty (BBNJ), aims to create an MPA framework for the high seas. This treaty enters into effect once 60 nations have ratified it. Hopes are that it can be completed for the next UN Ocean Conference in June 2025.

There are several tools available to the IMO to properly accommodate for MPAs, such as marking certain zones as no-anchoring or precautionary areas, providing recommendations on routes, tracks, and speed, and more. While it is still unknown, this could potentially result in an increase in sailing distances or a reduction in speeds.

Integrated, high-integrity market insight enables us to monitor the impact of key trends in the dry bulk shipping markets over time, make informed predictions, and shape business strategies accordingly. Let’s explore the Oceanbolt platform that provided data for the above market analysis.

Leveraging Oceanbolt for market insights

Oceanbolt combines a best-in-class AIS processing engine with a proprietary geospatial database of port and berth polygons to allow computationally expensive calculations to be processed in a matter of seconds, giving you the data you need to make dynamic, data-driven decisions. Today, Oceanbolt processes 30+ billion data points, makes 60+ million daily observations, and tracks 5+ billion tons of cargo each year over 140 commodities. Here are some of the ways you can use Oceanbolt data to glean market insights:

Oceanbolt’s global flows module enables you to track commodity exports and imports on a global scale. You can access both real-time and historical trade flow information to enable back-testing and near-term trend analysis. Data can be viewed as a daily time series or in aggregate, and you can drill down into specific trade flows and refine searches by specific criteria, such as by ton mile.

With granular visibility into global dry bulk port congestion and wait times, you can explore congestion data by port, country, region, and laden status. We can analyze congestion statistics in China, for example, by drilling down into congestion trends for coal over a specific period of time in the specific region. Data insights like these can enable data-driven decisions and help forecast demurrage impact on underway voyages.

If you have specific areas of interest that you would like to track and learn more about, such as the questions of ‘have coal shipments peaked?’ that we addressed earlier, you can easily pull specific data into a format that works best for you thanks to Oceanbolt’s API-first approach. Access all Oceanbolt data via well-documented APIs and SDKs (Python, R) to power your trading and freight models. In this example, we have pulled a list of voyages carrying coal. This allows your teams to spend more time on analysis and business logic rather than on structuring and cleaning data.

Granular visibility into your fleet can help you assess how you could be impacted by industry changes such as the introduction of the High Seas Treaty. Oceanbolt allows you to look at the distances traveled in MPAs across your fleet, helping you stay informed and proactive so you can make strategic decisions.

To see how Oceanbolt could work for you, explore this interactive demo or request a demo from our team of experts.