Maritime shipping has officially crossed the January 1 threshold for the EU’s emissions trading system, a decarbonization regulation expected to cost the industry more than $3 billion in 2024 alone.

The EU ETS for maritime operates as a cap-and-trade system, wherein European Union Allowances (EUAs) are auctioned and traded. Emissions incurred from the beginning of the year onwards will require the surrender of EUAs, calculated based on voyages to and from EU ports. A phase-in plan is set, starting at 40% in 2024, escalating to 70% in 2025, and reaching full implementation at 100% in 2026 and beyond. Immediate punitive measures for non-compliance will be effective from January, requiring the industry to take swift and calculated action.

Despite lingering uncertainties surrounding EU ETS details and industry responses to this regulatory complexity, one thing is for sure: this will have a substantial financial impact, even during the initial 40% phase-in. Establishing a scalable process to monitor emissions and manage risks within your daily operations is therefore crucial. A commercial solution capable of managing maritime EU ETS expenses in a standardized manner, from pre- to post-fixture, is highly beneficial and advantageous.

Are you setting yourself up for successful EU ETS compliance this year? Continue reading to explore practical approaches to compliance and how the Veson IMOS Platform‘s Emission Expense Settlement Workflow supports this significant regulatory development.

4 Steps for Early Success in Managing EU ETS Expenses

By closely monitoring regulatory changes and engaging in regular communications with clients and industry players, we have identified four key areas for early success in managing maritime EU ETS expenses. These include calculating emissions expense, actualizing emissions expenses, proving compliance and accounting for financials, and managing carbon risk. Let’s delve into where these fit into maritime workflows and how they can be addressed.

Step 1: Calculating Carbon

The chartering workflow is the starting point for calculating and integrating emissions into business decisions. The IMOS Platform features a Carbon Calculator, which simplifies the calculation of emissions expenses associated with different estimates. It updates automatically as elements like bunkers are modified, providing a clear visualization of the calculation process.

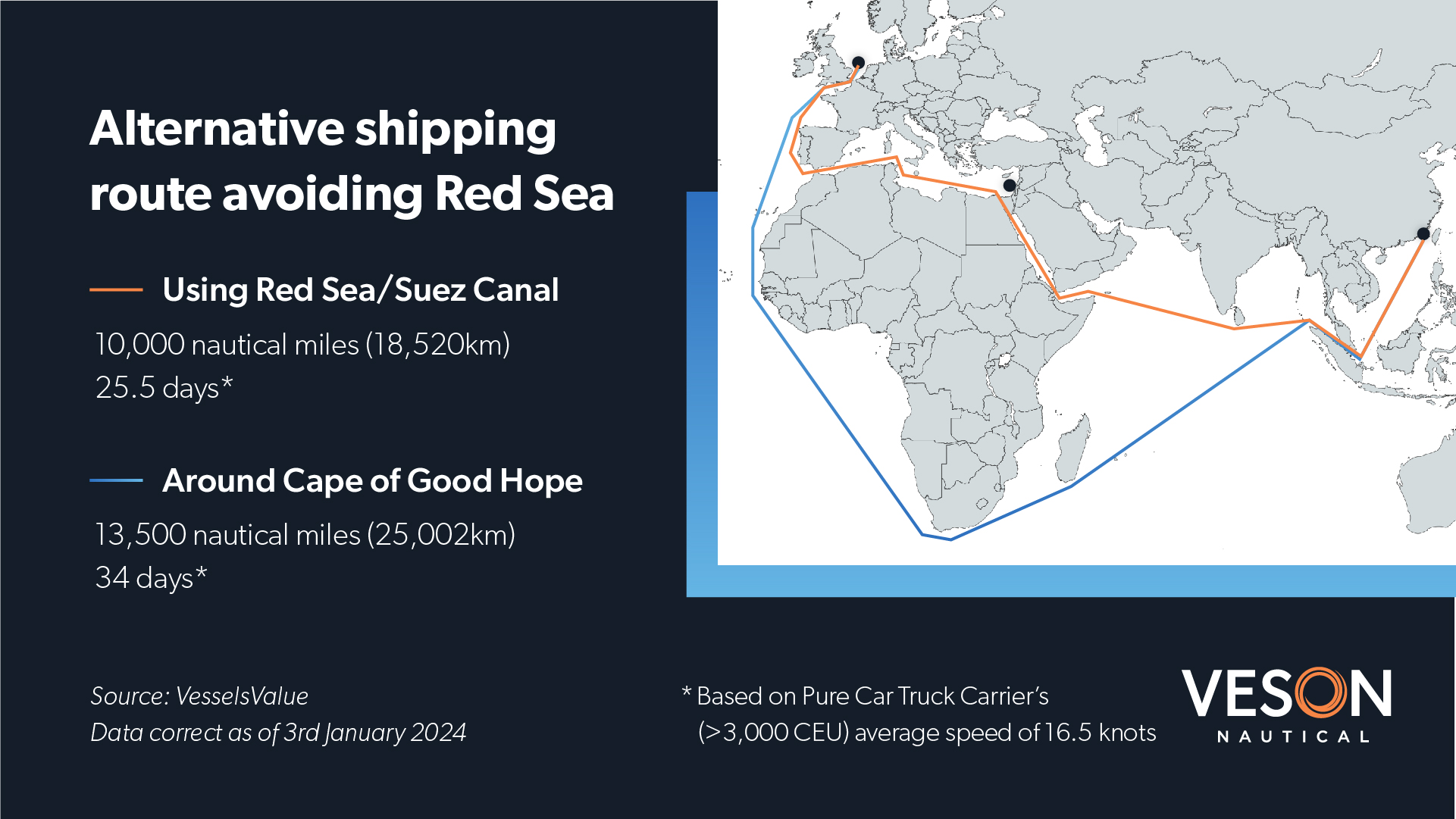

As an example, let’s use the Carbon Calculator to understand the emissions impact for an alternative shipping route that avoids the Red Sea. Assuming a capsize vessel is traveling at an average speed of 14.3kts, we can input some rough figures like a consumption rate of 45 MT/day and a CO2 factor of 3 to conclude that CO2 emissions for this alternate route would increase from 4,500 MT CO2 to 6,250 MT, also increasing those emissions that are applicable to the EU ETS phase-in from 2,370 MT to 3,120 MT. Using an EUA price of €70 and an exchange rate of 0.91, we can also see the equivalent EU ETS Emissions expense would increase significantly from around $182k to around $240k. While these inputs will be subject to the price movements in the market, the indication in this example is that the deviations in routing away from the Red Sea would increase CO2 emissions across all vessel types and would therefore also increase the emissions expense associated with the EU ETS for those routing into an EU country.

Step 2: Actualizing with Accuracy

Operations and voyage management is the stage where calculated emissions expenses are translated into noon reports. The IMOS Platform supports precise calculations by accommodating different definitions of berth consumption versus port consumption through a Port Activities Form, allowing the definition of ROBs. The platform also incorporates logic for the year split, enabling accurate accounting for voyage legs spanning multiple years.

Step 3: Proof in the P&L

Financials involve managing voyage P&L and understanding how to balance different contracts around transferring allowances or handling settlements. The IMOS Platform’s data, including the Carbon Calculator and voyage workflow, is reportable to facilitate proof of compliance. The cargo emissions table allows the allocation of emissions to different charterers based on cargo, following Sea Cargo Charter guidelines.

Step 4: Accounting for New Risk

In the context of a cap-and-trade system, it is crucial to assess your carbon risk within the EUA and EUA Futures market and devise strategies to hedge against volatility. At Veson, we approach this by firstly calculating and recording the associated exposure and risk for a specific physical contract. Subsequently, we capture and monitor paper trades and the underlying asset linked to the new market using the IMOS Platform. This platform serves as a central workspace, facilitating the easy calculation of mark-to-market values for physical trades, recording EUA futures in both EUR and USD, tracking them alongside physical contracts, and establishing an inventory of EUAs and EUA Futures contracts to analyze their impact on your net position.

A Seamless Workflow for Contracts, Invoicing, and Settlement

The responsibility for emissions expenses lies with those making decisions about a vessel’s route or fuel consumption. In time charter scenarios, owners are expected to pass expenses to vessel charterers, either through allowances or cash, integrated into the freight rate. These expenses then move from vessel charterers to cargo owners, payable in allowances or cash. Ultimately, the EU regulator will receive allowances in 2025 for the emissions occurring in 2024.

The IMOS Platform supports this chain of carbon costs throughout the lifecycle of a contract firstly by allowance settlement and expense accounting. This is the capturing and tracking of financials for the emissions expense as well as financials for these new instruments and contracts, as outlined in the prior section. Building on top of this is the ability to handle contractual agreement changes and allowance transfers by structuring time charter contracts in a way that aligns with industry standards while maintaining the flexibility to create your own clauses or negotiations. Then, to properly track and manage allowance transfers, we need to understand the available balance of allowances in inventory and ensure it stays updated as items get transferred out. IMOS does this by aligning the allowance inventory with what has been budgeted versus what is available to be allocated and what the current balance is at any time. Finally, IMOS provides functionality to support the revenue (cargo) side for scenarios where the freight rate is not inclusive of the carbon expense and additional handling is needed.

This comprehensive EU ETS contract management solution, designed to meet the immediate and evolving demands of this regulatory change, evolves with ongoing input and feedback from the maritime industry. We remain committed to refining this functionality to ensure continual support and flexibility.

To learn more on this topic and see the functionality for yourself, tune in on-demand to our on-demand EU ETS readiness webinar. You won’t want to miss out on this informative conversation and one of Veson’s most globally attended webinars to date – access the recording here.

Aidan Williams

Aidan Williams

Antoine Grisay

Antoine Grisay