For maritime organizations on both sides of the contract, managing financial and operational risk is essential. This is especially true amid significant market volatility, with the average spot rate having risen significantly over the past five years.

Financial and operational risk are closely related, and both require a significant level of planning and control to avoid surprises at period close. This necessitates comprehensive visibility throughout the workflow, which can best be achieved through data standardization, system integration, and other specialized capabilities that enable organizations to properly hedge risk.

Let’s step through four key areas where accurate, streamlined information and workflows are necessary to better manage marine risk, and how a commercial solution like the Veson IMOS Platform (VIP) can help.

Invoices

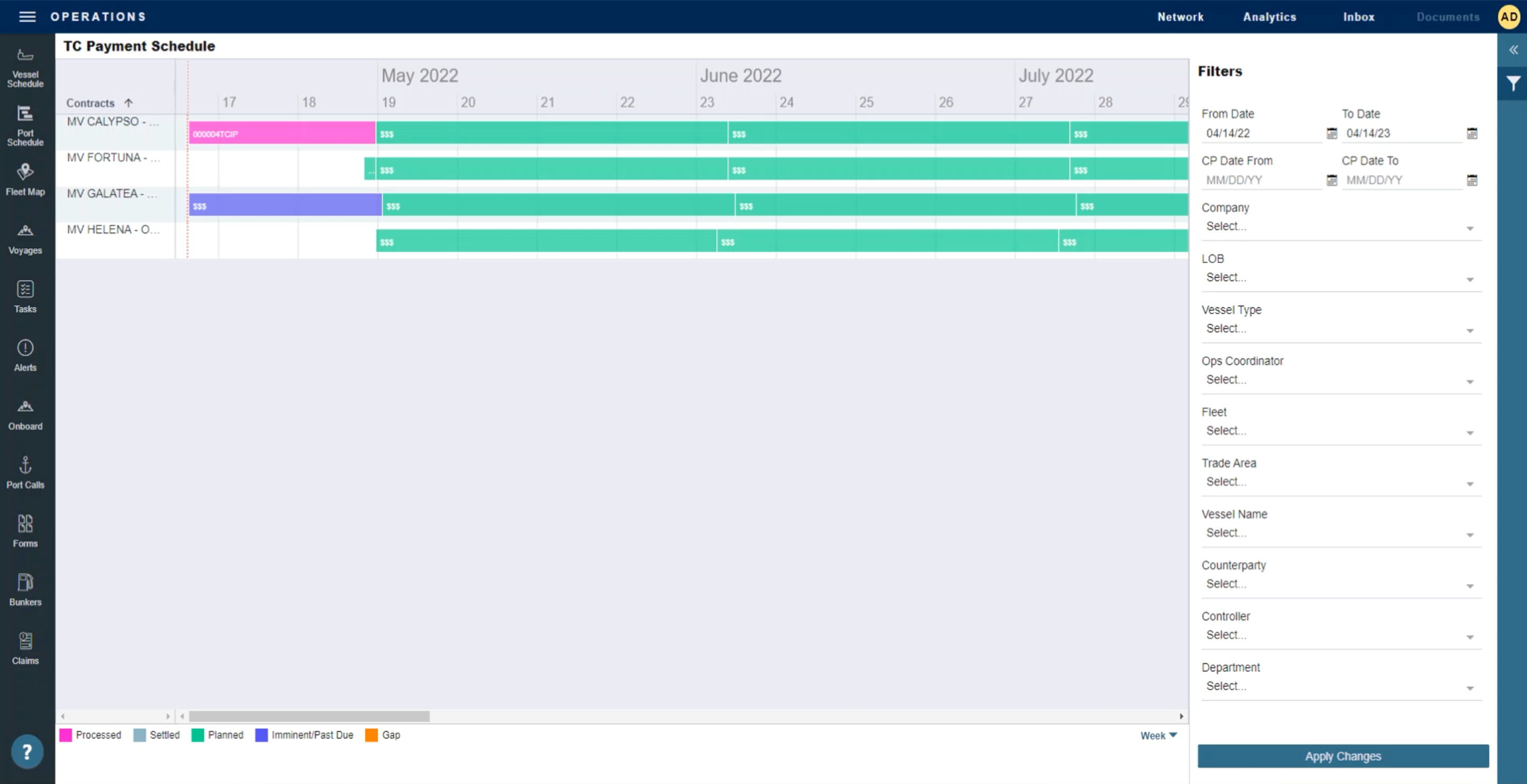

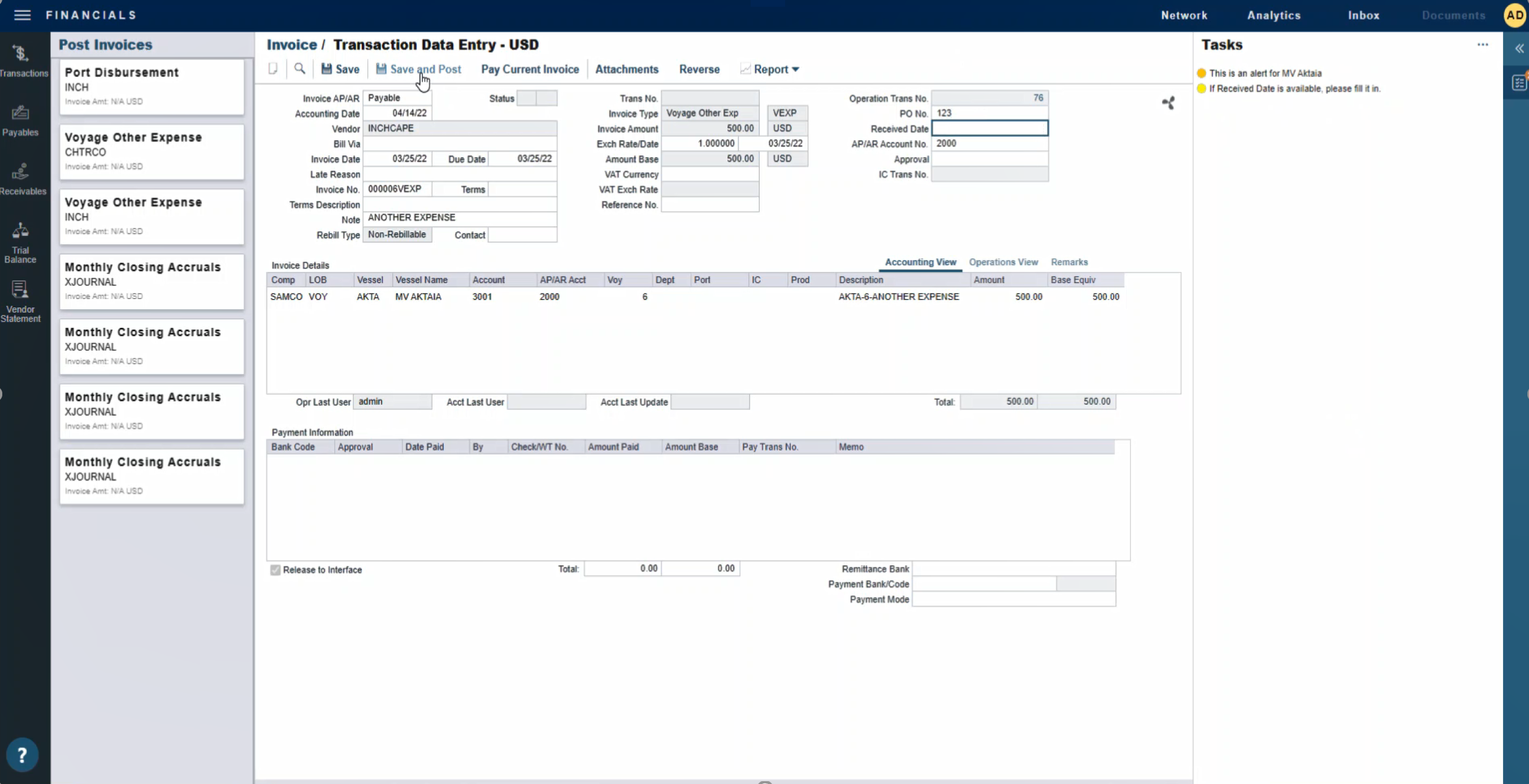

First, we have invoices. Simplifying the invoices process and ensuring everything is accounted for is essential for mitigating risk at this stage.

A commercial solution can support you by providing the ability to create invoices in a streamlined and automated manner, ensuring that no invoice is missed or delayed. Users can easily identify any gaps and overlaps that may be present to avoid duplicate or missed invoices, and enable the operations function to keep invoicing on track.

The Veson IMOS Platform (VIP) offers demurrage time bars, which enable users to catch every demurrage claim in a highly visual way, accounting for them in the invoicing process.

Approvals

Next, let’s discuss approvals. Not only does VIP aid in the creation and sending of invoices, it also helps ensure that invoices receive the right approvals from the necessary people in the right scenarios, and in a timely manner.

For optimal control, users can set specific rules around how many approvals are needed for each invoice and from whom. These rules can be configured based on the type of invoice and the amount, dramatically simplifying the approval process through automation. Users can then easily manage and enforce approvals within the system, avoiding bottlenecks and missed communications.

P&L Alerts & Reports

Third, we have P&L Alerts and Reports, which enable key stakeholders to easily identify and report on any variances.

The platform automatically delivers P&L swing alerts, which allow operators to quickly surface any outsized impacts and identify what may be causing them. With a dynamic P&L, organizations can constantly maintain a full view of their financial position and understand the impact of every decision throughout the workflow. Here, the operations team can easily keep track of variances.

VIP also provides advanced reporting capabilities, which allow users to investigate variances. Through these reports, stakeholders can evaluate the differences between voyage estimates and actuals, as well as actual and posted amounts.

Data

Finally, we have data, which is really the backbone of any decision for organizations on both sides of the maritime shipping contract, but especially so when it comes to proactive risk management.

With VIP, users can validate their operational and financial data to ensure accuracy. With seamless integration capabilities, VIP serves as a single source of truth, avoiding missed or duplicate data entry.

In addition, users can benefit from integrated tasks and alerts, empowering you to deliver the right information to the appropriate stakeholders at the right times. This gives the operations team the ability to understand past performance and actively uncover opportunities for improvement.

Finally, data and reporting in VIP can be fully tailored to the business. The platform enables you to configure your own rules based on your specific business requirements—from simple alerts to full stops and more.

To learn more about proactive operational and financial risk management and to see capabilities from the Veson IMOS Platform in action, watch this 30-minute On-Demand Webinar.