Commodity traders face an array of challenges that, if not properly managed, can significantly impact their operations and profitability. From maintaining complete awareness of volatility to managing geopolitical risks and appreciating the nuanced intricacies of maritime trades versus paper trades, the landscape is complex and ever-changing. Severe weather, shifting demand, and supply chain bottlenecks further complicate the picture. However, incorporating integrated, made-for-maritime solutions as your baseline operating system can deliver a strong foundation to further develop your strategy and navigate these challenges.

Let’s look at some examples of how you can strengthen your commodity trading operations:

Challenge 1: Market volatility

Problem: Lost volatility that traders are unaware of

Volatility itself is not a bad thing, in fact the more volatile the market the greater the potential profits. The danger of volatility is when we are unaware of it. Lost volatility means we are no longer the experts in our trade, which could then leave us no better off than anyone else dipping their toes into the market for the first time. Price, supply, and demand can all fluctuate due to various factors, including political events, economic shifts, and natural disasters. This is all inherent to our business but when we are unaware of even the slightest change, we start to enter precarious waters.

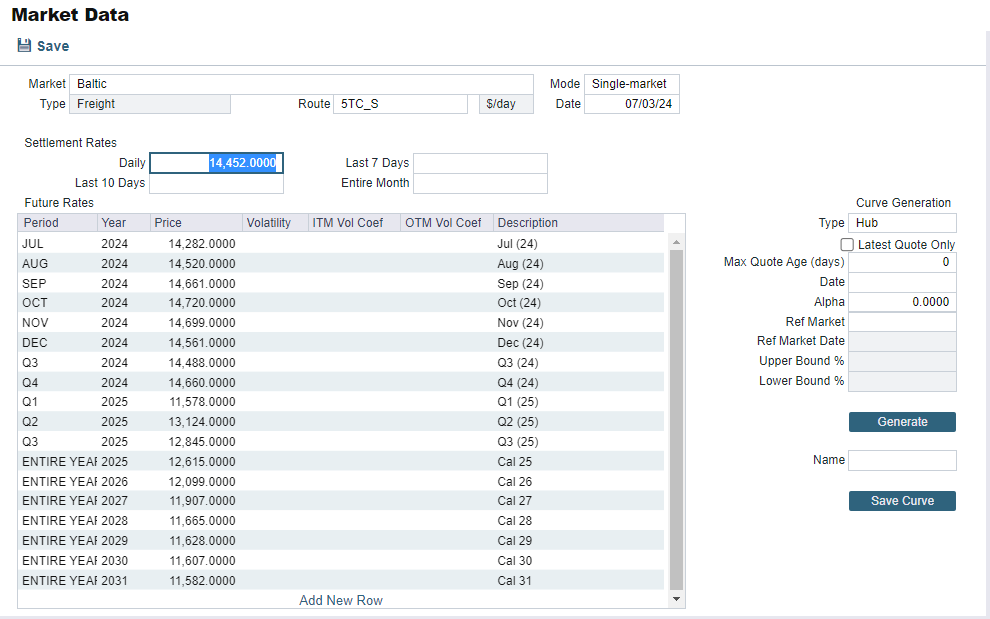

Solution: Keep a full picture of the shifting landscape

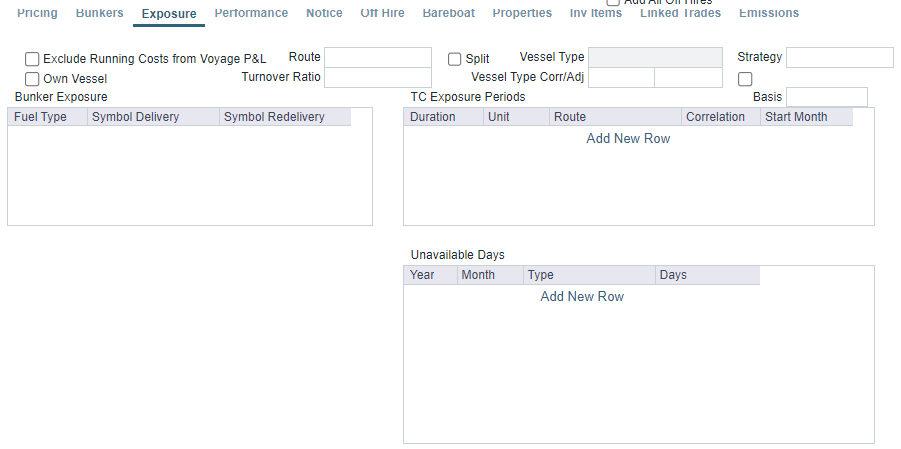

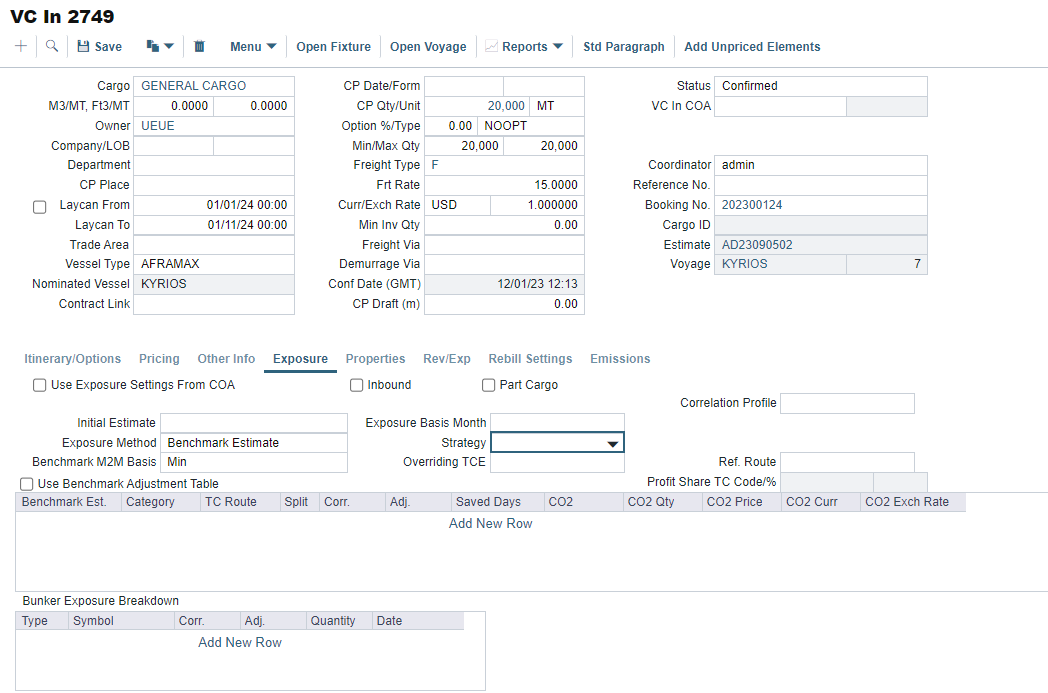

Volatility can be advantageous if properly managed, and digital solutions can be extremely helpful in identifying and analyzing volatility. By firstly capturing all the underlying contract details, then showing the appropriate market exposure and incorporating real-time updates, a view of the full picture becomes possible. This full picture of the market allows you to develop your strategy with the most tactical position and best inputs, allowing you to beat the market and your competitors. Additionally, traders can turn volatility into a strategic advantage by factoring in geopolitical risk and using data to anticipate market shocks. With a comprehensive maritime freight management solution, such as the IMOS Platform, the underlying contract and its lifecycle is mapped within the system and updated with operational data in real-time. This allows us to capture every step of a trade from inception to completion and display a single source of truth. With the native ability to then run correlation profiles and simulate market shocks, we can begin to view our portfolio with the nuance it necessitates.

Challenge 2: Geopolitical risks

Problem: Growing geopolitical risk

Geopolitical risks are increasing, especially as we enter an unprecedented time in history with most of the world entering an election year. Growing conflicts and political instability across the globe directly impact important commodity supply and, consequently, prices across the board. Traders must be aware of how this could impact their positions, and factor in these risks to protect their investments.

Solution: Establish a process for quantifying and factoring in risk

Trying to track and quantify all the geopolitical events unfolding globally can be overwhelming, which is where technology can provide support. The right commercial solution will allow you to overlay proprietary risk valuations with underlying market symbols, get a granular break out of your positions, and incorporate these insights into your trading strategies. This proactive approach allows traders to anticipate and mitigate potential disruptions caused by geopolitical events. In IMOS, how you set and value your market exposure is entirely up to you and can be adjusted to suit your organization’s risk appetite, shareholder targets, and commercial goals. With the ability to set correlations and adjustments, break out trade areas and commodity grades, and even create heat maps, a comprehensive view of your exposure to various markets is always at your fingertips.

Challenge 3: Managing the unique intricacies of maritime risk

Problem: Lack of insight into maritime transportation operations, including supply chain disruptions

Understanding maritime transportation is crucial for commodity traders, given the significant impacts it can have on a trade’s bottom line. Profit can disappear in a moment due to unforeseen delays, maritime risks, and inefficiencies in transportation. Supply chain disruptions in particular can have a significant impact. For example, the Kiel institute showed that when Rhine water levels fell, some vessels were forced to sail only a quarter full. Oftentimes, we see a trade as ‘point A to point B’ and think of the ‘to’ in between is the easy part. But, as anyone with a deep understanding of the maritime industry knows, the maritime leg of the trade carries the most risk and is far from simple smooth sailing.

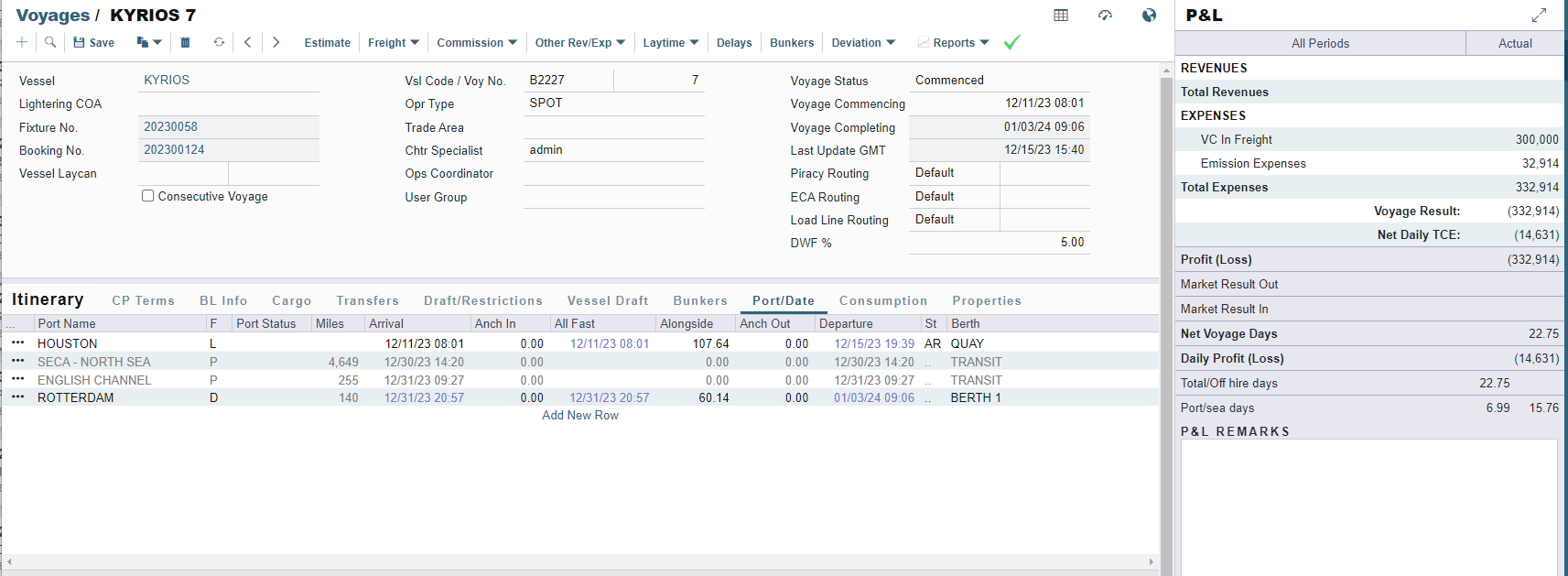

Solution: Real-time operational data, supply chain insights, and delay management

Comprehensive operational data is an essential prerequisite to maintaining control and visibility of your trades. Consistent updates from the vessel, operators, and your financials teams keep you consistently on top of things and allow you to get ahead of any potential delays and their expected impact on the balance sheet. This way, traders stay proactive and safeguard performance, conducting any necessary trades to keep positions covered. IMOS covers all of this, providing detailed insights into supply chain operations. This allows you and your teams to identify bottlenecks in real time and make immediate adjustments, minimizing disruptions and enabling smoother transportation.

Challenge 4: Severe weather impacts

Problem: Severe weather disruptions

Severe weather events can disrupt trade routes and schedules, leading to delays and increased costs. Traders need real-time data to mitigate these impacts and adjust their strategies accordingly. Natasha Brown, the acting head of the IMO, stated, “the maritime sector needs to be aware of increased risks to shipping and ports from more intense storms,” highlighting the growing effect adverse weather can have on ports, ships, and overall trade.

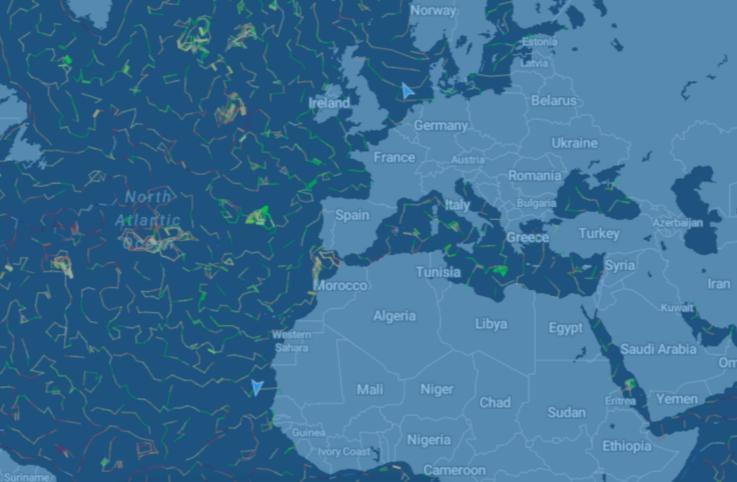

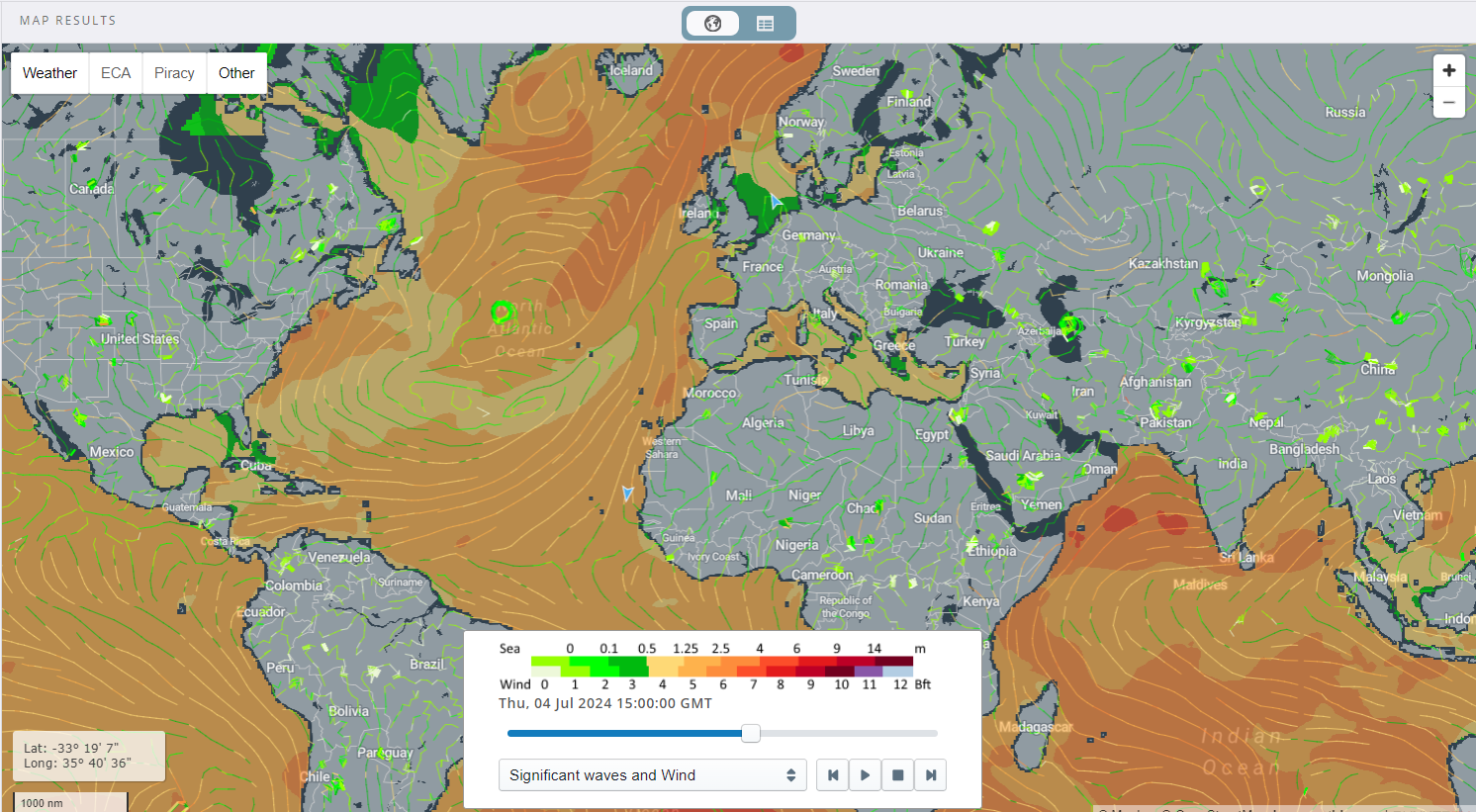

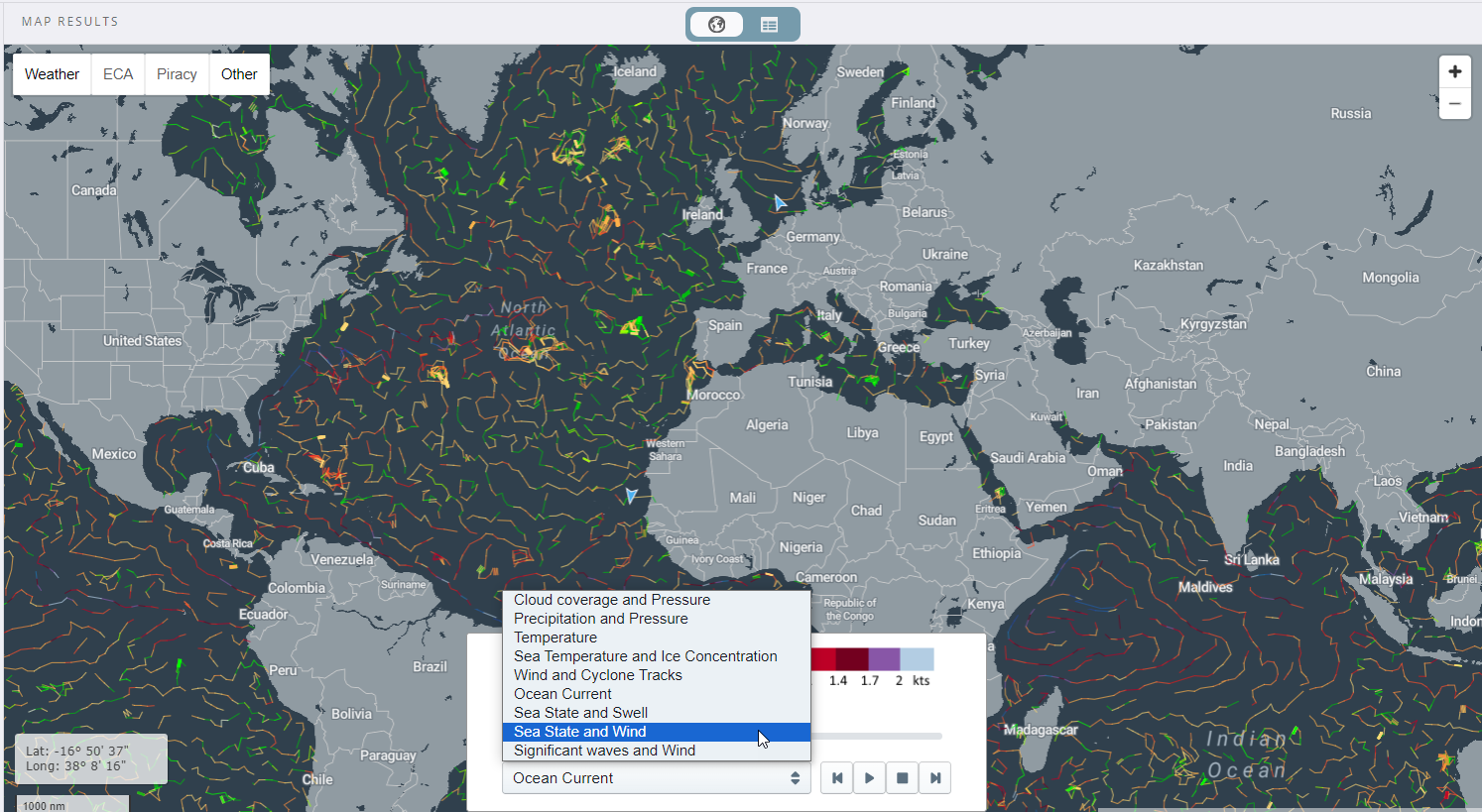

Solution: Fleet mapping and weather data integration

Visualizing weather patterns, whether historical or forecasted, can help highlight areas to pay special attention to, and what it could mean for your operations in the region. Being able to overlay vessels alongside weather data gives the option to see not only what may directly impact you, but also what might impact the broader market. As IMOS integrates weather data with fleet mapping to show sea states, operators can easily inform ships to amend voyage orders and run quick, accurate estimates to see the impact any deviation may have on the P&L of a voyage. This capability is vital for reducing operational delays caused by severe weather conditions and ensuring voyages continually move forward.

Challenge 5: Shifting demand

Problem: Rapid shifts in commodity demand

Supply and demand is lesson one in trading, so it’s no surprise that tracking shifting demand, whether caused by economic changes, consumer behavior, or seasonal factors, is integral to profitable trades. Traders must stay ahead of these shifts to make informed decisions, improve negotiation power, and set long-term strategies.

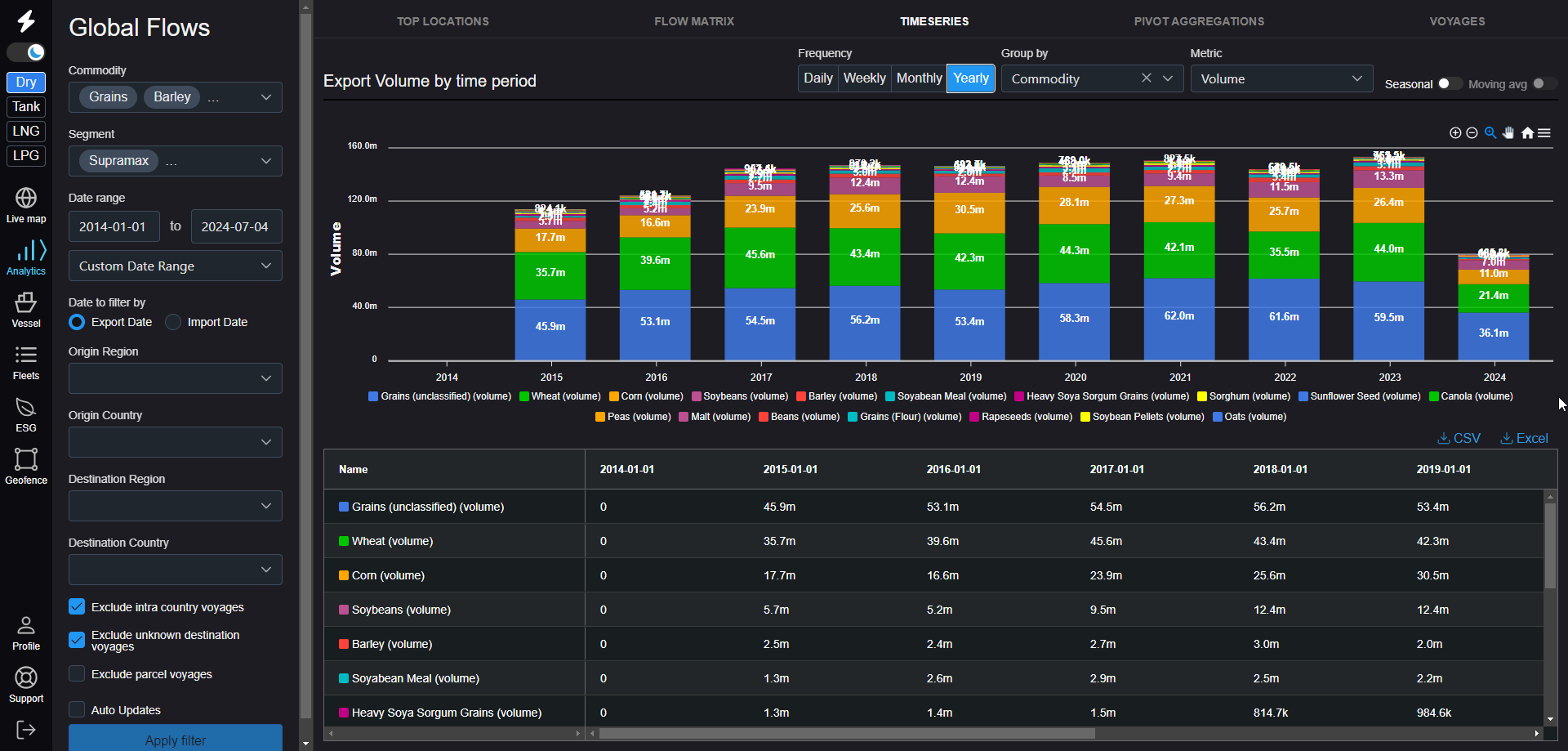

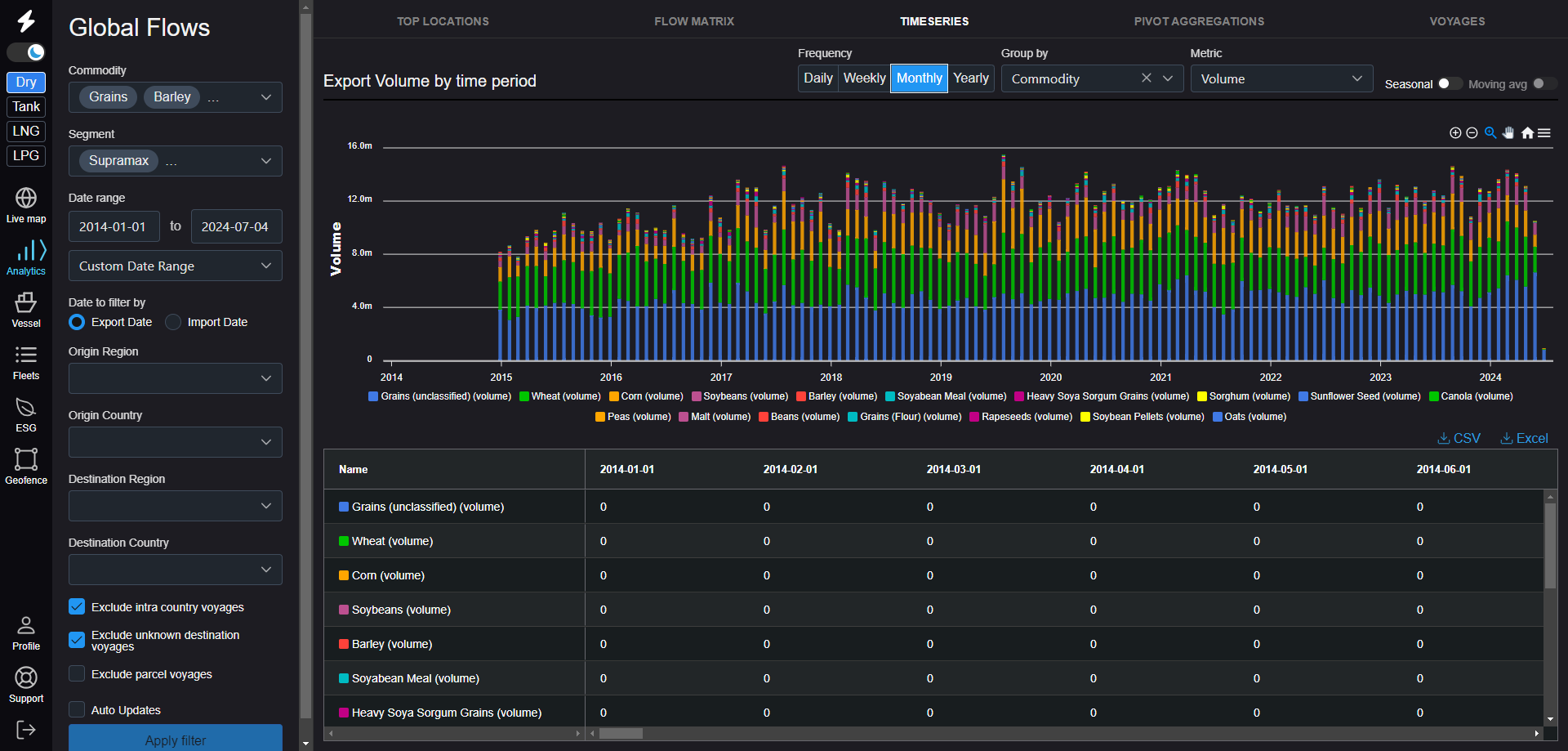

Solution: Seasonal analysis

A data analytics solution, such as Oceanbolt, grants insight into global tonnage, breaking out data by commodity grades, regions, ports, and more. With this detailed view into demand, you and your teams can conduct seasonal analysis and view global flows, congestion data, and trade lanes. Traders can then understand and anticipate price shifts in freight and commodity rates and get the foresight that is crucial for strategic planning and maximizing profits.

Technology that is tailor-made for you

That’s a lot of variables to weigh out as commodity traders go about their daily decision-making processes. As the world continues to change, industries are finding new ways to leverage technology to improve structure and streamline operations, allowing their talented teams to do their jobs better and more strategically.

The IMOS Platform and Oceanbolt offer comprehensive solutions for commodity traders looking to turn challenges into creative opportunities. IMOS’s commercial freight contract management and voyage execution provides real-time P&L updates, operational data, and fleet mapping to enhance decision-making and operational efficiency. Oceanbolt’s dynamic data intelligence delivers in-depth analysis of maritime data, offering seasonal insights into demand and freight rates, crucial for understanding market trends and making informed trading decisions.

By integrating your chosen digital solutions into day-to-day operations, you can manage volatility, mitigate risks, and optimize their operations for better profitability. These tools provide the unique insights, real-time data, and analytical capabilities needed to navigate the shifting complexities of the commodity trading landscape effectively.