The latest dual-fuel market penetration data from VesselsValue reveals a stark divergence between Bulker and Tanker segments. Both sectors’ embrace of alternative fuel technologies signals significant implications for the future emissions profile of the global fleet.

Tankers:

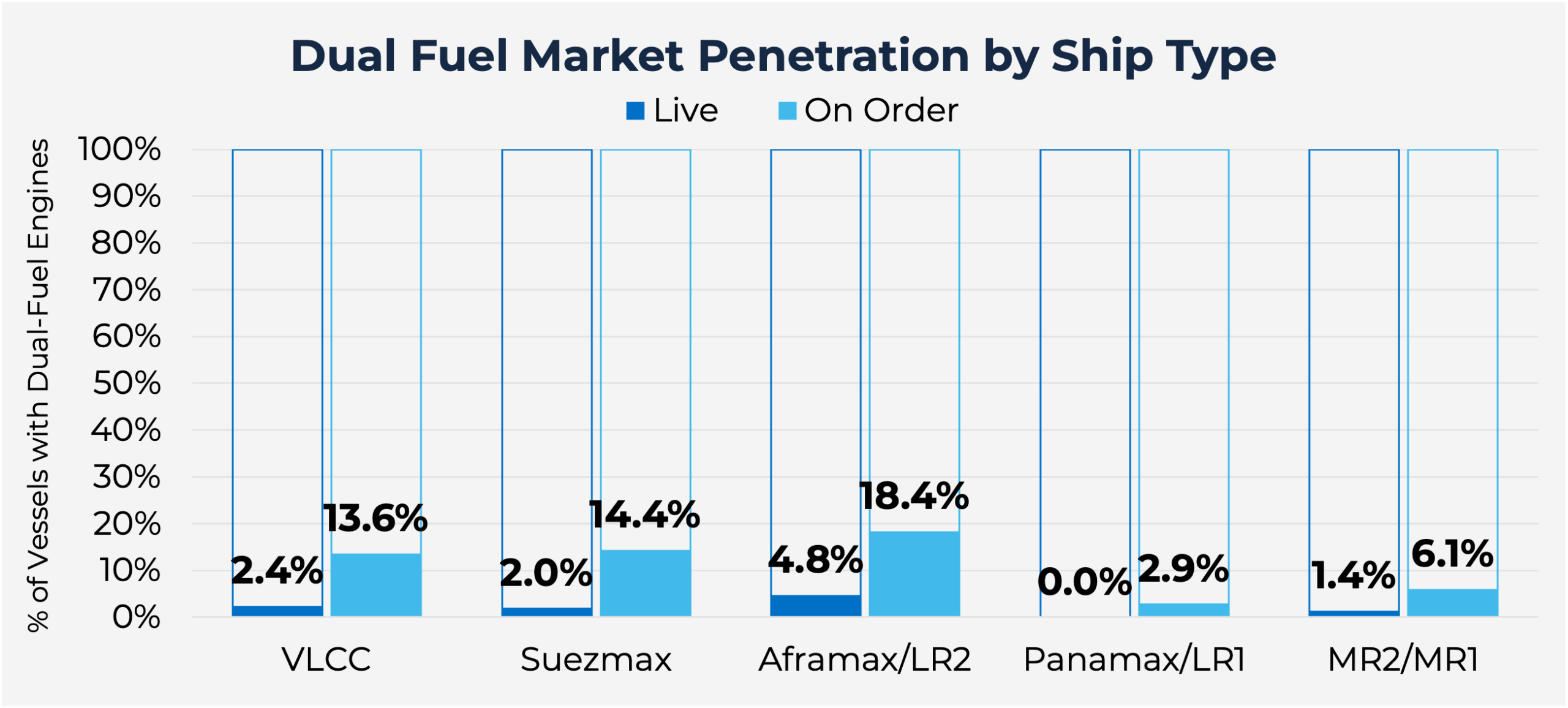

In the Tanker sector, dual-fuel adoption remains in its early stages, with live fleet penetration ranging from 0% for Panamax/LR1 vessels to just 4.8% for Aframax/LR2 tonnage. However, the orderbook data signals a fundamental shift in newbuilding strategy.

Aframax/LR2 vessels lead the transition with 18.4% of vessels on order specified with dual fuel capability, followed by Suezmaxes at 14.4% and VLCCS at 13.6%. This substantial orderbook shift reflects shipowners’ response to tightening emissions regulations, particularly the International Maritime Organization’s (IMO) CII requirements and anticipation of future carbon pricing mechanisms.

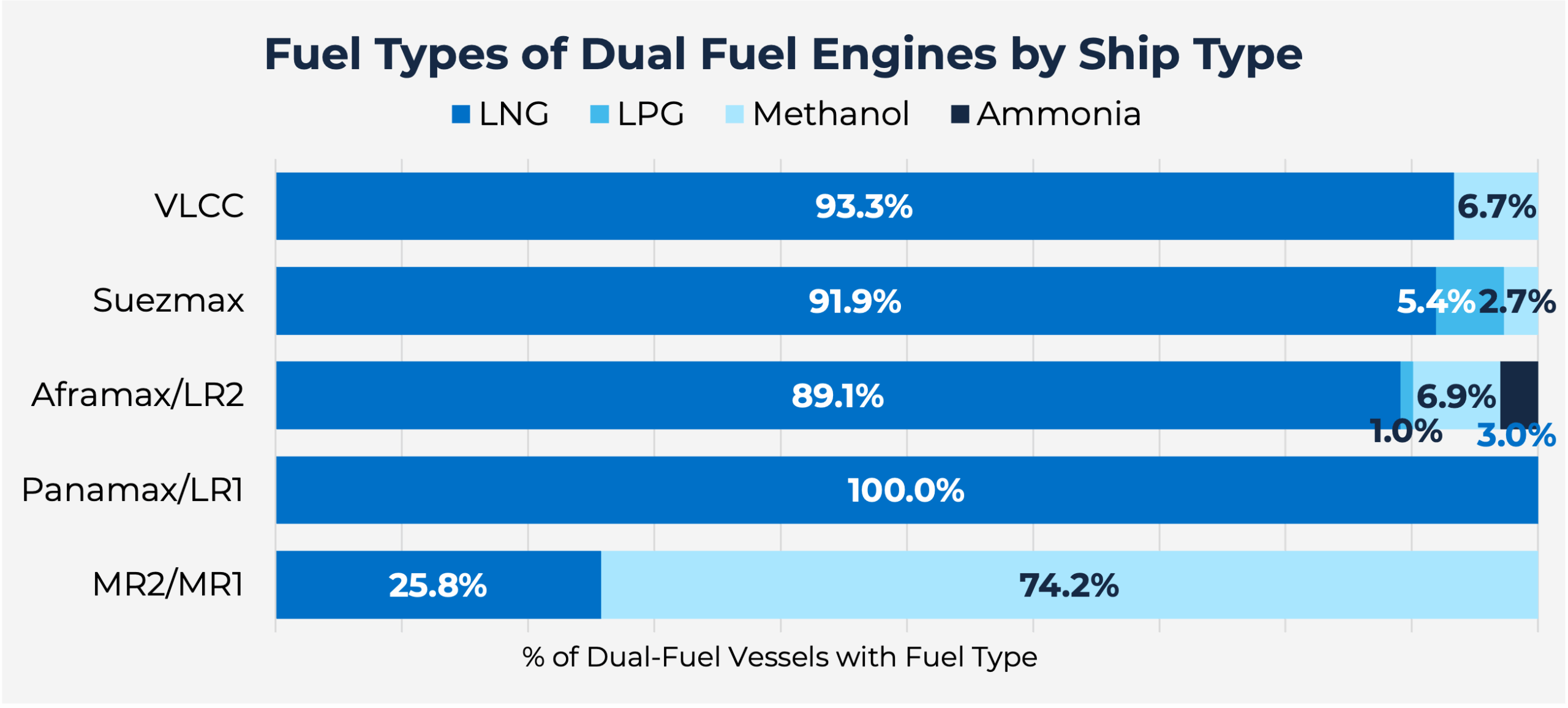

LNG dominates as the alternative fuel of choice across Tanker sub sectors, with 93.3% of dual-fuel VLCCs, 91.9% of Suezmax, and 89.1% of Aframax/LR2 vessels equipped for LNG propulsion. This preference stems from LNG’s established bunkering infrastructure, proven technology track record, and immediate emissions benefits — compared to conventional marine fuel oil. The MR2/MR1 segment is the exception, with methanol capturing 74.2% of the dual-fuel market versus just 25.8% for LNG. This reflects MRs’ role as methanol carriers, giving them built-in advantages such as methanol handling experience and fuel access at cargo ports.

Bulkers:

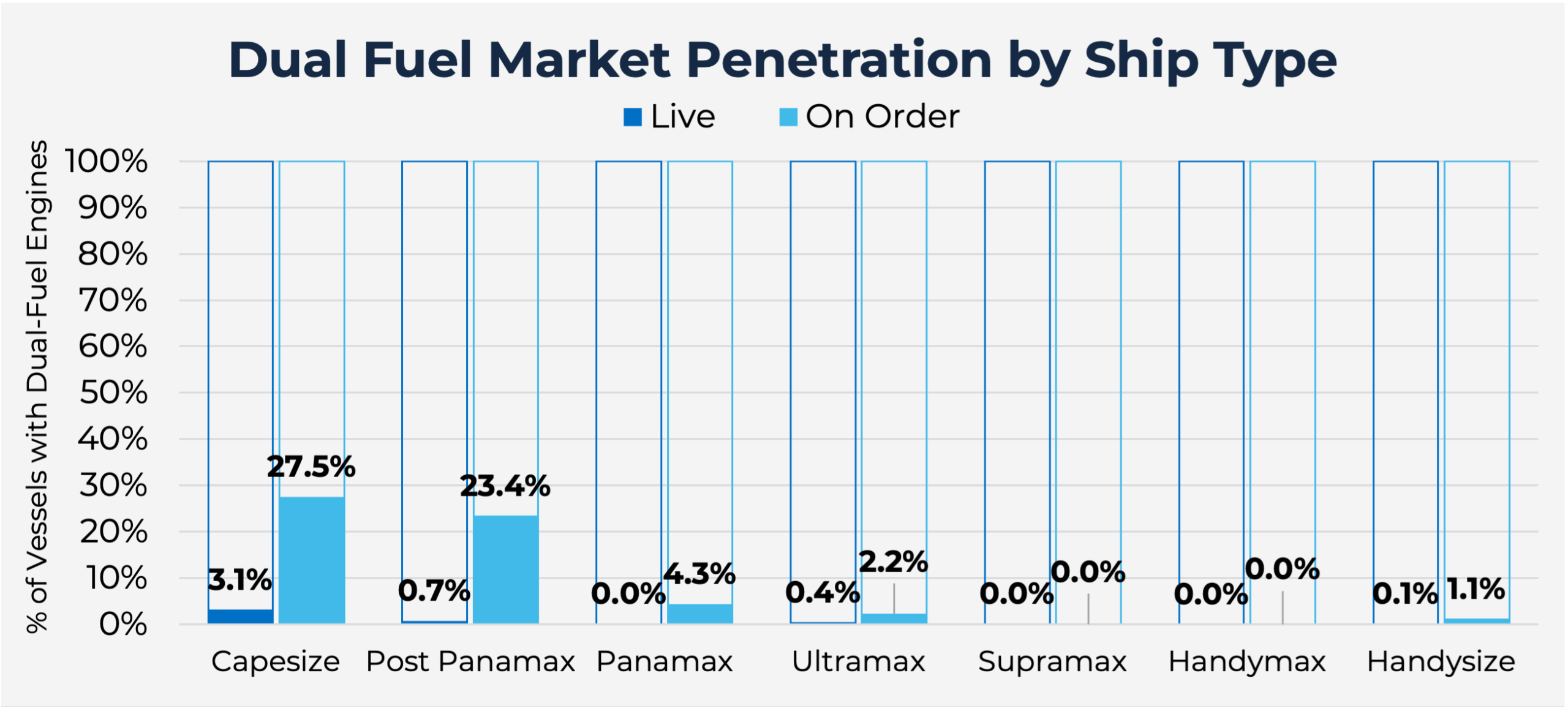

The Bulker sector demonstrates substantially higher dual-fuel adoption, particularly amongst larger vessel classes. Capesize vessels show 3.1% of the live fleet already operating with dual fuel engines, rising to 27.5% on order — the highest adoption rate across all segments analysed. Post Panamax Bulkers follow with 23.4% orderbook penetration. This pronounced uptake in the Bulker sector reflects several market drivers which include charterers’ increasing environmental preferences and commitments from major mining companies that require cleaner vessel specifications.

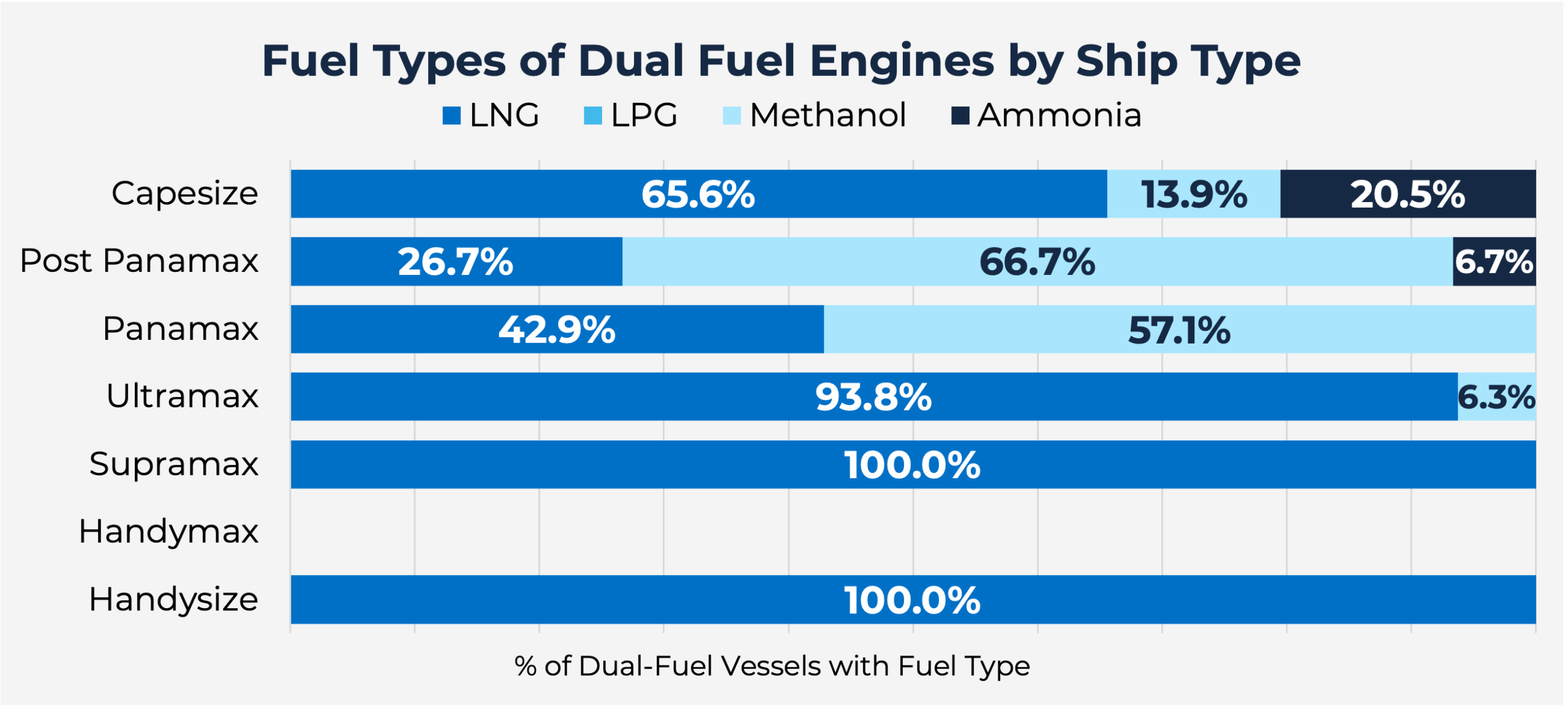

Alternative fuel-type preferences in the Bulker segment reveal greater diversity than Tankers. Capesize vessels favour LNG at 65.6% but show notable methanol adoption at 13.9% and ammonia interest at 20.5%. Post Panamax vessels demonstrate the strongest methanol commitment at 66.7% of dual-fuel tonnage, whilst Panamax vessels are split between LNG at 42.9% and methanol 57.1%. Supramax and Handysize classes show complete LNG preference at 100%, though sample sizes remain limited given minimal dual-fuel penetration in these smaller segments.

The pronounced uptake in the Bulker sector reflects concentrated demand from major mining companies with aggressive decarbonisation targets. Leading iron ore producers including BHP, Rio Tinto, Fortescue, and Anglo American have driven a wave of dual-fuel newbuilding orders through long-term charter commitments, requiring alternative fuel capability to meet emission-reduction goals across their supply chains.

The fixed-route nature of iron ore trades between Brazil/Australia and China provides predictable bunkering locations, making the development of alternative-fuel infrastructures commercially viable for these dedicated trades. In contrast, Tanker charterers, primarily oil companies and traders, currently face less stakeholder pressure on shipping emissions and operate more diverse trading patterns, resulting in the Tanker sector’s comparatively modest orderbook penetration.

Looking Ahead

VesselsValue’s orderbook data indicates dual-fuel technology will reshape both sectors’ environmental credentials over the next few years as these new vessels deliver. However, the concentration of orders in larger vessel classes suggests a split in the fleet profile emerging, with older, smaller tonnage potentially facing charter market disadvantages as emissions regulations intensify.

Shipowners face complex decisions balancing first-mover technology risks against regulatory compliance requirements and charterer preferences, whilst fuel availability infrastructure continues developing across global bunkering hubs. The methanol versus LNG debate remains unresolved, with different vessel segments backing competing technologies based on trading patterns, infrastructure access, and long-term carbon reduction pathways.

WEBINAR