Booking the best cargo or the best vessel at the best possible rate is at the heart of the chartering and nominations functions. And yet, the ‘best’ decision can change—sometimes from hour to hour. Missing information can delay decision making and impact cargo or vessel availability in ways that are more than inconvenient—leading to significant opportunity cost.

The delta between an optimal decision and a suboptimal one is the cost of a missed opportunity. While most stakeholders recognize that missed opportunities have a bottom-line impact, few organizations have a concrete understanding of just how much.

To make the best decisions with maximum agility, charterers need unrestricted access to all insights that might impact their decision, including external market data and internal communications data from email and other sources. In other words, they require continuous information in context — something best supported by modern chartering solutions that centralize, structure, and surface mission-critical insights at the moment of decision.

In this blog, we’ll step through some scenarios that illustrate the importance of continuous information and capture the cost of missing a cargo or ship.

The cost for vessel owners and operators

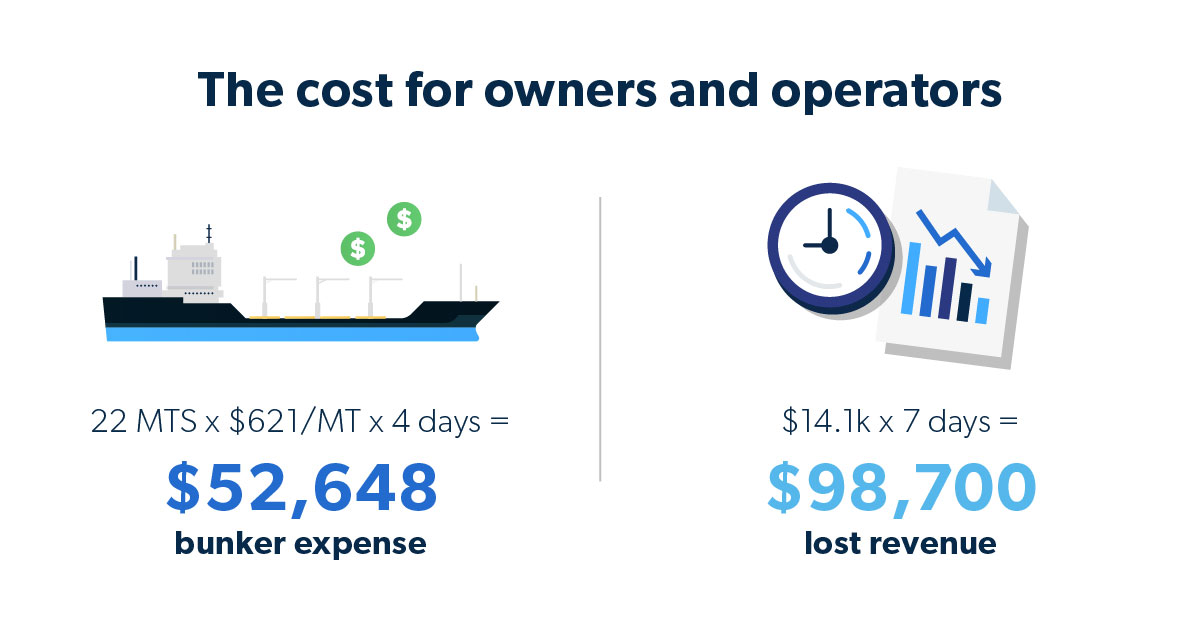

For vessel owners and operators, missing cargo can lead to a cascade of financial setbacks. The simplest to calculate is the impact on earnings due to extended wait times. For example, consider this scenario using data sourced from Shipfix via the Baltic feed. In the process of tracing down rate information, an owner-operator misses a grain cargo and must wait seven additional days for the next suitable cargo in its region. If current earnings for dry Panamaxes stand at $14.1K/day, this missed opportunity equates to a significant loss of $100K.

The missed cargo can drive up costs when it comes to fuel consumption, too. If we look at the same ship from the scenario above and factor in bunker prices and consumption rates for the modern Panamax, consuming 22 MTS/day and requiring MGO/ULSF at a price of $621/MT, the added expense comes out to $13.6k/day. An extended ballast of four days, then, means $55K in extra bunker expense. And this doesn’t even account for EU ETS—if the vessel is within the EU ETS region, the owner may incur additional costs due to added emissions.

The cost for charterers and commodity traders

From the perspective of those seeking ships to transport their cargo, the consequences of a delayed decision are equally impactful, if not more so.

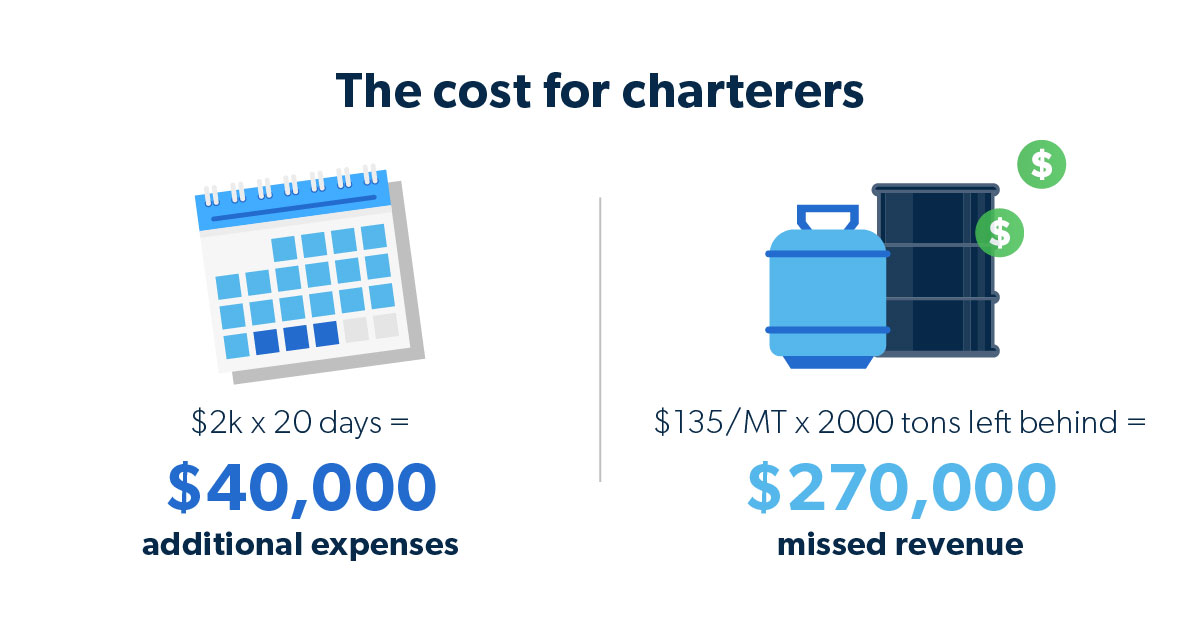

After missing a ship, charterers typically pay a higher rate for a replacement. Paying a premium for an already costly vessel, such as the Panamax we mention above, can significantly erode profit margins. For instance, if the average cost to charter a Panamax is $14K per day, and the charterer must pay an extra $2K per day for a 20-day voyage, they stand to incur a hefty $40K in added expenses that could have been avoided.

Limitations in cargo capacity due to a missed opportunity can also result in foregone revenue. If a charterer gets stuck with a vessel that can load less on the draft, that means less cargo can be moved. For example, iron ore is currently trading at ~$135/MT, but if the charterer or commodity trader must leave behind 2k tons of planned cargo due to space constraints, that can total about $270K less in revenue than originally anticipated.

In the case of regulatory impact, missing a ship can necessitate settling for one with higher carbon emissions, and that can mean higher charges. For example, when using an older MR tanker for a round trip voyage compared to a newer vessel, a charterer is accountable for 130 MT of CO2, or 26% more for the full voyage, or about 100 MT of CO2, or 22% more for the laden voyage.

Finally, missed delivery dates because of a missed or undiscovered ship can lead to shifts in arbitrage opportunities, causing charterers to narrow their margin and further erode profitability. These challenges are often magnified when teams lack the right ship chartering software, capable of consolidating real-time vessel availability, market movements, and internal communication streams.

Multiplying the opportunity cost

These costs are impactful on their own, but they are remarkable in aggregate. For example, if an operator has a fleet of 100 vessels that each embark on five voyages a year, their potential opportunity cost could reach seven figures even if delayed decision making only affects a small percentage of voyages. On the cargo side, if a charterer moves a dozen cargoes a year, the profitability impact could also eclipse one million USD.

Continuous information = enhanced profitability

If you suddenly find yourself tallying up voyages and cargoes, you’re not alone. Many maritime shipping organizations have not yet reclaimed their opportunity cost due to the episodic and fragmented ways in which they access and utilize critical information. Stakeholders continue to work in silos and consult multiple solutions. With multiple solutions comes operational complexity, and with operational complexity comes a critical loss in decision making agility.

By contrast, continuous information allows key details to move freely and without delay, meeting stakeholders in moments of critical decision making and delivering tangible insight in the formats they find most valuable.

Veson’s comprehensive decision-making ecosystem for the pre-fixture workflow ensures this information flow and decision-making agility. To learn more, watch our Unlock Your Decision Advantage: A Streamlined Pre-Fixture Process webinar.

The connection between Veson and Shipfix specifically enables new levels of information continuity for owner-operators, commodity traders, and charterers alike. By empowering stakeholders with timely, accurate, and actionable insights Shipfix makes the ‘continuous information’ standard achievable, accelerates decision making, and safeguards profitability in the dynamic maritime space.

Through a native, bi-directional integration, Shipfix and IMOS bring together the trade’s best market data and its leading freight management platform, creating a pre-fixture powerhouse that eliminates inefficiencies and sharpens decision-making. With full visibility into market opportunities, competitive positioning, and business context, chartering teams can align seamlessly from market assessment to execution—reducing risk, cutting complexity, and keeping deals moving at the speed of opportunity.

If you’re interested in hearing more about the combined benefits of Veson and Shipfix, check out our latest webinar on-demand below.